The State Treasury publishes a quarterly review, which includes information on recent developments in debt management and an outlook for the upcoming quarter.

Summary:

– Long-term funding operations for 2022 are well advanced with all of the euro-denominated supply in syndicated form completed

– Auction dates for Q4 have been published

– Government announced a EUR 10 billion loan and guarantee scheme for the energy sector. State Treasury foresees any funding need for the lending facility to be covered by short-term borrowing.

– Finland’s GDP is projected to grow by 1.7% this year, but the growth will slow down to 0.5% in 2023.

– Prefer to read this as PDF? Here it is.

Outlook for the Finnish economy and public finances

Russia’s invasion of Ukraine continues and it is overshadowing the economic outlook internationally and in Finland. Economic growth is slowing and inflation accelerating more than previously expected. Finland’s GDP is projected to grow by 1.7% in 2022 but will decline to 0.5% in 2023, according to the forecast of the Ministry of Finance.

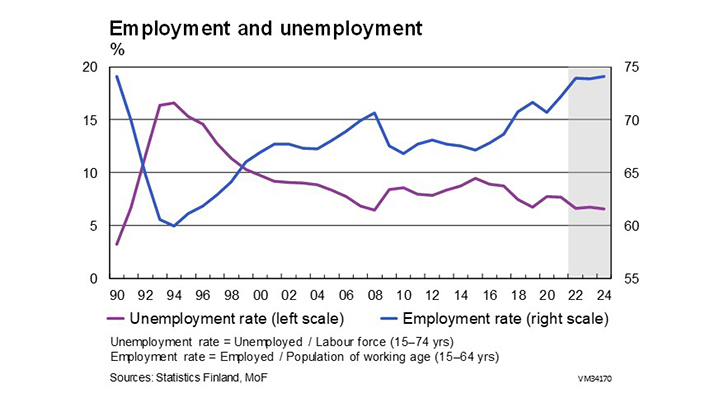

Inflation forecast is 6.5% for this year, but in 2023 it is expected to slow considerably. The current account will show a rather small deficit in 2022 and the unemployment rate will fall this year to 6.6%. The trend employment rate reached 74% in June, the highest level ever recorded as currently measured.

The large imbalance in general government finances caused by the COVID-19 pandemic has been reduced by the robust economic and employment growth. Economic growth will slow this year, but employment growth will remain strong and general government finances will improve, boosted by the strong growth of tax revenue. In 2022, the general government deficit is expected to be around 1.4% of GDP, while the central government deficit will be 2.3% of GDP.

The general government debt will stand at 71.2% of GDP this year. The ratio increased by about 6 percentage points in the summer due to Statistics Finland implementing a change in methodology. The central government debt is expected to be 50.8% of GDP, according to the estimates of the Ministry of Finance.1

[1] Ministry of Finance: Economic Survey, Autumn 2022.

Latest on Finland and ESG: Top of EU in digitalisation

Finland is the most digitalised country in Europe, according to the EU’s annual evaluation of digital performance. DESI 2022 assessed the member states in areas including human capital, connectivity, integration of digital technology and digital public services. Strong tradition of preparedness in data and cyber security were mentioned in the report as Finland’s particular strengths.

Review of Treasury operations by the State Treasury, July to September 2022

On 23 August 2022, Finland raised EUR 3 billion with a benchmark bond maturing on 15 April 2027. This was the third benchmark issue of the year. The bond was priced at 57 basis points below the euro swap curve, which is the tightest pricing versus swaps on record for an RFGB. The final order book amounted to over EUR 10 billion with over 60 investors participating. The trend of rising interest rates was reflected the re-offer yield of 1.412%.

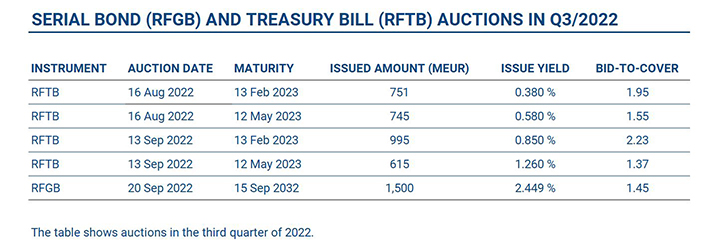

In Q3, the Republic of Finland conducted auctions of bonds and euro-denominated Treasury bills. The results of these actions are summarised below.

The tap window for T-bill issuance in EUR and USD denominated bills was open in September, producing EUR 2.8 billion and USD 2.0 billion of issuance with maturities between 3 to 5 months.

Near-term outlook for the period of October to December 2022

The government’s latest supplementary budget for 2022 (dated 5 September) includes a EUR 10 billion loan and guarantee scheme for the energy sector. This lending facility is a precautionary measure by which the government prepares for granting loans. Thus, the government’s net borrowing in 2022 could be as high as EUR 18.9 bn, but will depend on the actual take-up of loans under the facility. Due to harsh terms for the loans and alternative funding opportunities available, the use of the lending facility remains a last-resort option. The State Treasury foresees any funding need for the lending facility to be covered by short-term borrowing, i.e. bills issuance given the pre-payment options included in the facility.

Long-term funding operations for 2022 are well advanced with all of the euro-denominated supply in syndicated form completed.

To complete the long-term funding requirement for the year, one or two more tap auctions of existing euro benchmark bond lines may take place in the last quarter of the year. The next bond auction will take place on 18 October. Further details on the auction and an updated auction calendar are published on: Serial bond auctions.

As in previous years, bonds may be issued under the EMTN programme to complement the funding in euro benchmark bonds during the year, market conditions permitting.

The next auctions of euro-denominated Treasury bills are expected to take place on 11 October and 8 November. The auctions will be arranged in the Bloomberg Auction System and are open to the RFTB dealer group. Further information on Treasury bill auctions and a quarterly updated auction calendar will be published on: Treasury bill auctions.

In addition to Treasury bill auctions, a tap issuance window for bills is likely to open during the last quarter of the year. The timing of the Treasury bill issuance is subject to the liquidity position and refinancing needs of the central government. Treasury bills are issued in euros and US dollars with monthly maturity dates.

The next Quarterly Review will be published on 22 December 2022.

Further information: Teppo Koivisto, Director of Finance, tel. +358 295 50 2550, or Mika Tasa, Treasury Front Office, tel. +358 295 50 2552, firstname.surname@statetreasury.fi