The State Treasury publishes a quarterly review, which includes information on recent developments in debt management and an outlook for the upcoming quarter.

Summary:

– In Q3, the State Treasury is planning to issue a new euro benchmark bond in Q3, likely in 5-year maturity

– Auction calendar for Q3 has been published.

– At the end of Q2, approximately 55% of foreseen long-term funding has been completed

– Russia’s war in Ukraine weakens outlook for the Finnish economy and slows down exports growth. Ministry of Finance expects Finland’s GDP to grow by 1.4% this year.

– Inflation is projected to be 5.8% this year, next year price pressures are expected to ease.

– The target of a carbon-neutral Finland by 2035 has been enshrined in the new Climate Change Act entering into force in July. The Act includes emission reduction targets for 2030 and 2040, and the target for 2050 is updated

– Prefer to read this as PDF? Here it is.

According to the latest forecast by Ministry of Finance, the Finnish economy is expected to grow by 1.4% in 2022.

Outlook for the Finnish economy and public finances

The continuation of Russia’s war of aggression in Ukraine, the rise in energy prices and the consequent acceleration of global inflation overshadow the outlook for the global economy. The Ministry of Finance expects Russia’s invasion of Ukraine to have a significant adverse effect also on Finland’s foreign trade. Private consumption in Finland will grow slowly in the coming years as inflation is cutting household purchasing power and consumption opportunities.

Finland’s GDP will grow by 1.4% in 2022 and by 1.1% in 2023, according to the forecast of the Ministry of Finance. Increase in consumer prices will be 5.8% this year, next year price pressures are expected to ease. The current account will be close to balance and the unemployment rate will fall this year to 6.7%.

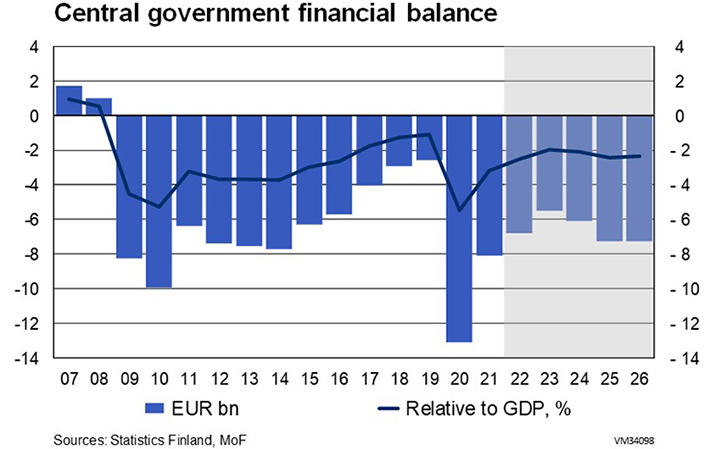

The imbalance in general government finances caused by the COVID-19 pandemic decreased sharply last year. General government finances will continue to strengthen this year, fuelled by rapid tax revenue growth and a reduction in the support measures taken due to the pandemic. In 2022, the general government deficit will be around 1.4% of GDP, while the central government deficit will be 2.5% of GDP, according to the latest Economic Survey of Ministry of Finance.1

1 Ministry of Finance: Economic Survey, Summer 2022

Latest on Finland and ESG: New Climate Change Act into force in July

The target of a carbon-neutral Finland by 2035 has been enshrined in the new Climate Change Act entering into force in July. The Act includes emission reduction targets for 2030 and 2040 that are based on the recommendations of the Finnish Climate Change Panel, and the target for 2050 is updated. The targets are -60% by 2030, -80% by 2040 and at least -90% but aiming at -95% by 2050, compared to the levels in 1990.

Finland ranks first in international comparison of sustainable development. The Sustainable Development Report, conducted annually by UN SDSN and the Bertelsmann Foundation, assesses countries’ progress on implementing the 2030 Agenda for Sustainable Development and its SDG’s.

Review of Treasury operations by the State Treasury, April to June 2022

On 25 May 2022, in its second euro benchmark issue of the year, the Republic of Finland raised EUR 3 000 million with a new 10-year benchmark bond, maturing on 15 September 2032. The bond was priced at 15 basis points below the euro swap curve. Final order book amounted to over EUR 13 billion, and the issue was allocated to over 80 investors at a yield of 1.530%.

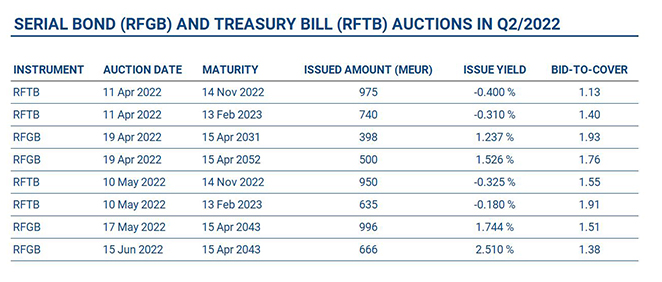

In Q2, the Republic of Finland conducted auctions of bonds and euro-denominated Treasury bills. The results of these actions are summarised below.

The tap window for T-bill issuance in USD-denominated bills was open twice in April, producing USD 2.8 billion of issuance with maturities of 3 and 6 months.

Near-term outlook for the period of July to September 2022

The government’s latest supplementary budget for 2022, dated 25 May, indicates a net borrowing requirement of EUR 8.9 billion which implies gross borrowing of EUR 30.6 billion. At the end of the second quarter, approximately 55% of foreseen long-term funding has been completed.

The State Treasury is planning to issue a new euro benchmark bond in the third quarter of the year, likely in August – September. The potential maturity of the bond is foreseen in the 5-year sector.

The next bond auction will take place on 20 September. Further details on the auction and an updated auction calendar are published on: Serial bond auctions.

As in previous years, bonds may be issued under the EMTN programme to complement the funding in euro benchmark bonds during the year, market conditions permitting.

The next auctions of euro-denominated Treasury bills will take place on 16 August and 13 September. The auctions will be arranged in the Bloomberg Auction System and are open to the RFTB dealer group. Further information on Treasury bill auctions and a quarterly updated auction calendar will be published on: Treasury bill auctions.

In addition to Treasury bill auctions, an issuance window for bills is likely to open on more than one occasion during the second half of the year. The timing of the Treasury bill issuance is subject to the liquidity position and refinancing needs of the central government. Treasury bills are issued in euros and US dollars.

The next Quarterly Review will be published on 30 September 2022.

Further information: Senior Manager Mika Tasa, Treasury Front Office, tel. +358 295 50 2552, firstname.lastname(at)statetreasury.fi or Mika Arola, Deputy Director, tel. +358 295 50 2604