Summary:

– State Treasury is planning to issue a new euro benchmark bond in Q3, likely in 5-year maturity

– Auction calendar for Q3 has been published

– At the end of Q2, approximately 70% of foreseen long-term funding has been completed

– In 2023, Finland’s GDP will remain at the previous year’s level but the economy is expected to pick-up in the latter part of the year. GDP is forecast to grow by 1.4% in 2024 and by 1.9% in 2025.

– Finland’s new government is set to curb public debt and to strengthen general government finances by EUR 6bn during its term.

– Other priorities of the next four years include promoting clean energy transition, reforming basic social security, and increasing R&D funding to meet the overall target of 4% of GDP by 2030.

– Prefer to read this as PDF? Here it is.

Outlook for the Finnish economy and public finances

In 2023, Finland’s GDP will remain at the previous year’s level, according to the latest forecast of the Ministry of Finance. In particular, rising prices and interest rates have slowed household consumption and private investment. However, demand is expected to recover in the latter part of this year.

GDP is projected to grow by 1.4% in 2024 as household purchasing power improves due to slowing of price inflation and rise of household income. In 2025 the Ministry of Finance expects economic growth to increase to 1.9%, with domestic demand being supported by growth in consumption and investments related to the green transition. Employment will return to growth next year. In 2025, the employment rate is forecast to be 74.6% and the unemployment rate 6.6%.

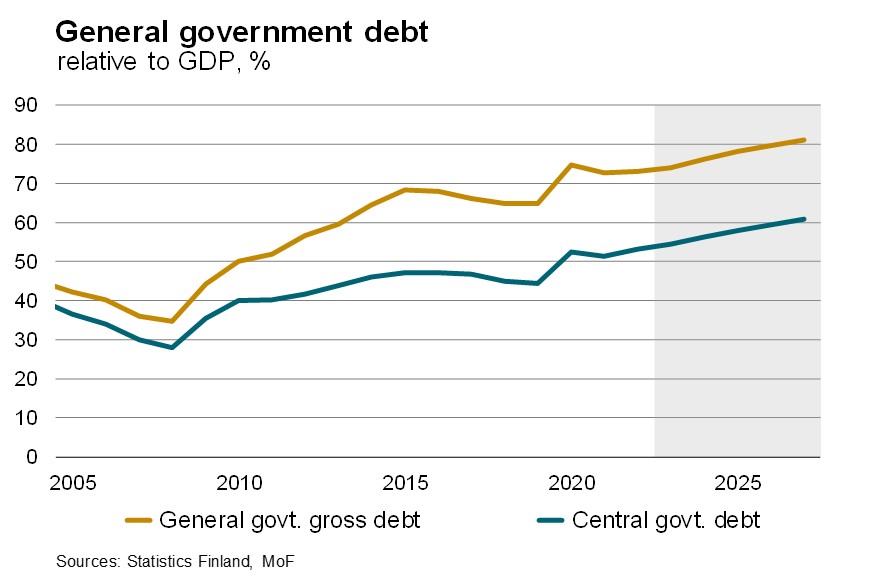

The Ministry of Finance expects the general government deficit to be 2.4% this year, while the central government deficit will be 3.5% of GDP. The general government debt ratio has begun to increase again. The general government debt is expected to be this year 74% relative to GDP while the forecast for the central government debt is 54.4%.[1] Forecast does not include the upcoming government programme’s measures aimed at strengthening general government finances.

[1] Source: Ministry of Finance: Economic Survey, Summer 2023.

Latest on Finland and ESG: New government’s plan for 2023-2027

Finland’s new right-wing government, led by Prime Minister Petteri Orpo, is set to curb public debt and to strengthen general government finances by EUR 6bn during its term. Direct austerity measures will be accompanied by growth and employment measures by which the government seeks balanced general government finances by 2031. The incoming government’s other priorities include promoting clean energy transition, reforming basic social security, and increasing the public R&D funding to meet the overall target of 4 per cent of GDP by 2030.

Finland holds the top spot in 2023 SDG Index, but according to Sustainable Development Report 2023, global progress on Sustainable Development Goals has been static for the third year in a row. The report is an annual assessment of progress for all UN member states towards the SDG’s.

Review of Treasury operations by the State Treasury, April to June 2023

The second euro benchmark bond in 2023 was launched on 26 April. The new 10-year bond maturing on 15 September 2033 with an issue size of EUR 3 billion was priced at 1 basis points below the euro swap curve. Over 90 investors participated in the issue. The bond has a coupon of 3%, and yield at issue was 3.032%.

During Q2, the Republic of Finland conducted bond and Treasury bill auctions. The auction results are summarised below. The State Treasury introduced optional reverse inquiry (ORI) auctions in March to support the secondary market liquidity of off-the-run bonds by auctioning them in limited amounts. Two ORI auctions took place in the second quarter.

In addition to T-bill auctions, a tap window for T-bill issuance in USD-denominated bills was open during April, producing in total USD 1.9 billion of issuance with an average maturity of 6.7 months.

| SERIAL BOND (RFGB) AND TREASURY BILL (RFTB) AUCTIONS IN Q2/2023 | |||||

| INSTRUMENT | AUCTION DATE | MATURITY | ISSUED AMOUNT (MEUR) | ISSUE YIELD | BID-TO-COVER |

| RFTB | 11 Apr 2023 | 13 Nov 2023 | 1,003 | 3.200% | 1.36 |

| RFTB | 11 Apr 2023 | 13 Feb 2024 | 1,001 | 3.250% | 1.81 |

| RFGB | 18 Apr 2023 | 15 Sep 2028 | 500 | 2.836% | 2.06 |

| RFGB | 18 Apr 2023 | 15 Apr 2047 | 985 | 3.064% | 1.24 |

| RFGB | 27 Apr 2023 | 15 Sep 2025 | 160 | 2.779% | 1.47 |

| RFGB | 27 Apr 2023 | 15 Sep 2029 | 209 | 2.865% | 4.23 |

| RFTB | 9 May 2023 | 13 Nov 2023 | 975 | 3.260% | 1.71 |

| RFTB | 9 May 2023 | 13 Feb 2024 | 975 | 3.300% | 1.82 |

| RFGB | 16 May 2023 | 15 Apr 2038 | 935 | 3.175% | 1.68 |

| RFTB | 6 Jun 2023 | 13 Feb 2024 | 1,000 | 3.485% | 1.45 |

| RFTB | 6 Jun 2023 | 14 May 2024 | 1,001 | 3.480% | 1.71 |

| RFGB | 13 Jun 2023 | 15 Sep 2033 | 921 | 2.980% | 1.31 |

| RFGB | 13 Jun 2023 | 15 Apr 2036 | 498 | 3.133% | 2.26 |

| RFGB | 15 Jun 2023 | 15 Apr 2026 | 201 | 2.995% | 1.78 |

| RFGB | 15 Jun 2023 | 15 Sep 2029 | 201 | 2.949% | 2.86 |

Near-term outlook for the period of July to September 2023

In the government budget, the net borrowing requirement for 2023 remains at EUR 10.419 billion. The gross borrowing amount in 2023 is EUR 38.456 billion. At the end of the second quarter, approximately 70% of foreseen long-term funding has been completed.

The State Treasury is planning to issue a new euro benchmark bond in Q3, likely in August – September. The potential maturity of the bond is foreseen in the 5-year sector.

The next bond auction will take place on 19 September. Further details on the auction and an updated auction calendar are published on: Serial bond auctions. The auction calendar for Q3 includes an optional serial bond auction (ORI) on 17 August.

As in previous years, bonds may be issued under the EMTN programme to complement the funding in euro benchmark bonds during the year, market conditions permitting.

The next auctions of euro-denominated Treasury bills will take place on 15 August and 12 September. The auctions will be arranged in the Bloomberg Auction System and are open to the RFTB dealer group. Further information and a quarterly updated auction calendar will be published on: Treasury bill auctions.

In addition to auctions, an issuance window for bills is likely to open on more than one occasion during the second half of the year. The timing of the Treasury bill issuance is subject to the liquidity position and refinancing needs of the central government. Treasury bills are issued in euros and US dollars.

The next Quarterly Review will be published on 29 September 2023.

Further information: Senior Manager Mika Tasa, Treasury Front Office, tel. +358 295 50 2552, firstname.lastname(at)statetreasury.fi