Summary:

– In Q2, the State Treasury is planning to issue a second new euro benchmark bond, likely in 10-year maturity.

– Auction calendar for Q2 has been published

– State Treasury has introduced ORI auctions to facilitate auctioning off-the-run bonds in limited amounts

– 60 per cent of the annual long-term funding is expected to be completed by the end of June

– According to the latest forecast, the Finnish economy will return to growth at the end of the year following a mild and short recession, barring new surprises.

– Prefer to read the review as PDF? Here it is.

Outlook for the Finnish economy and public finances

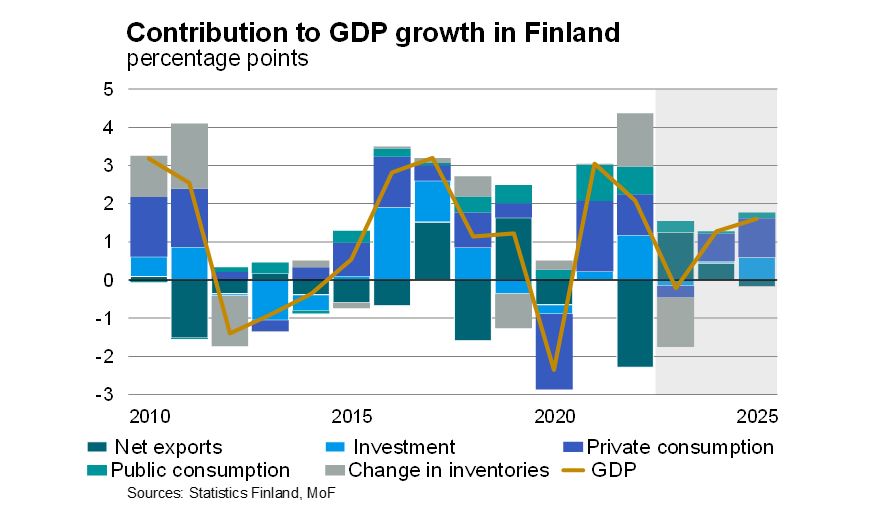

According to the new economic forecast of the Ministry of Finance, the Finnish economy will return to growth at the end of 2023 following a mild recession. Households have reduced their consumption as a result of rapid inflation and rising interest rates. Following economic growth of 2.1% last year, GDP is expected to contract by 0.2% this year, but purchasing power will begin to rise as inflation slows and salaries and wages increase during 2023. The Finnish economy is expected to grow 1.3% in 2024.

Employment growth has remained strong, and employment is at a record-high level. However, the declining economic situation is also reflected in the labour market. The unemployment rate is estimated to rise to 7% in 2023. Inflation is this year projected to slow to an average of 5.5%. The improved global outlook will help Finnish exports turn to growth in 2023, and the rate of growth will increase in 2024. However, the current account is forecasted to show a deficit in 2023.

The general government budgetary position has improved considerably, driven by the fast nominal growth of the economy and increasing employment. The deficit will begin to increase this year and is expected to be 2.6% in relation to GDP in 2023, according to the forecast of the Ministry of Finance. The general government debt will stand at 74.4% in the end of this year. The estimate for the central government debt in 2023 is 54.5% in relation to GDP.*

* Source: Ministry of Finance: Economic Survey, Spring 2023

Latest on Finland and ESG: Finland named world’s happiest country for 6th year running

According to The World Happiness Report 2023 – a global initiative of the United Nations – Finland continues to occupy the top spot with a score that is significantly ahead of all other countries. WHR 2023 research leverages six key factors to help explain variation in self-reported levels of happiness across the world: social support, income, health, freedom, generosity, and absence of corruption.

Finland will hold parliamentary elections on 2 April 2023. Once a new coalition government is formed and government programme published, the State Treasury will update its ESG information site to reflect any adjustments in climate, social, employment and growth policies. Currently the consensus in sustainability policy goals among parliamentary parties is fairly broad.

Review of Treasury operations by the State Treasury, January to March 2023

The first syndicated issue of the year on 26 January was a new EUR 3 billion benchmark bond maturing on 15 April 2038. The 15-year tenor attracted an order book of over EUR 11 billion, and over 90 investors participated in the deal. The bond was priced 10 basis points over the euro mid-swap curve with a re-offer yield of 2.875%.

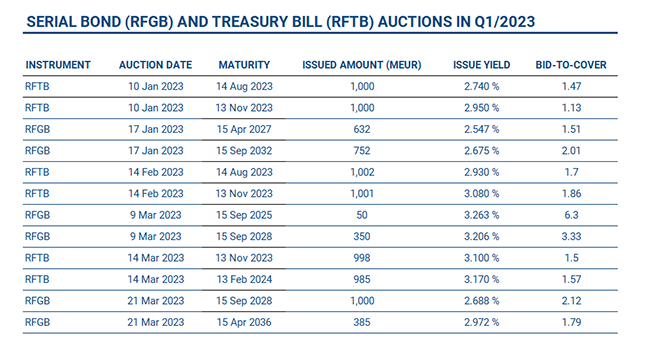

In Q1, the Republic of Finland conducted auctions of serial bonds and euro-denominated Treasury bills. The results of these auctions are summarised below. These include an inaugural optional reverse inquiry (ORI) serial bond auction conducted on 9 March. The State Treasury has introduced ORI-auctions to facilitate auctioning off-the-run bonds in limited amounts to support their market liquidity.

In addition to auctions, the tap window for Treasury bill issuance in EUR and USD-denominated bills was open in January. Issuance volumes in tap format were EUR 2.1 billion and USD 850 mio in respective currency. Average maturity for EUR-denominated was 3.9 and for USD, 3.5 month.

Near-term outlook for the period of April to June 2023

According to the latest supplementary budget by the government for the year, dated 2 February, the net borrowing requirement is estimated at EUR 10.419 million, resulting in a gross borrowing amount of EUR 38.456 billion. Approximately EUR 19.5 billion of this amount is expected to be covered with long-term debt, and the rest (19.0 billion) with short-term debt.

In the second quarter of the year, the State Treasury is planning to issue a second new euro benchmark bond, which is likely to have a 10-year maturity. The long-term funding operations are expected to include three euro benchmark bond tap auctions during the quarter. The State Treasury estimates to complete about 60 per cent of the above annual long-term funding by the end of June.

The next bond auction is expected to take place on 18 April 2023. Further details on the auction and an updated auction calendar are published on: Serial Bond Auctions. The auction calendar for Q2 includes two ORI serial bond auction dates.

As in previous years, bonds may be issued under the EMTN programme to complement the funding in euro benchmark bonds during the year, market conditions permitting.

The next auction of euro-denominated Treasury bills will take place on Tuesday 11 April 2023. The auction will be arranged in the Bloomberg Auction System and is open to the RFTB dealer group. Further information on Treasury bill auctions and a quarterly updated auction calendar will be published on: Treasury bill auctions.

In addition to Treasury bill auctions, an issuance window may open during the second quarter of the year. The timing of the Treasury bill issuance is subject to the liquidity position and refinancing needs of the central government. Treasury bills are issued in euros and US dollars.

The next Quarterly Review will be published on 30 June 2023.

Further information: Deputy Director Anu Sammallahti tel. +358 295 50 2575 or Senior Manager Mika Tasa at Treasury Front Office, tel. +358 295 50 2552, firstname.surname@statetreasury.fi