Summary

– Most recent forecast for 2024 by the Ministry of Finance includes a net borrowing requirement of EUR 12.88 billion. With redemptions of EUR 30.16 billion, the gross borrowing requirement amounts to EUR 43.04 billion.

–Three new euro benchmark bonds can be expected in 2024, out of which the first is likely to take place in Q1.

– Auction dates for Q1 have been announced.

– Realised net borrowing in 2023 amounted to EUR 14.4 billion, resulting in gross borrowing of EUR 42.4 billion.

– Finland’s economy will turn to growth next year, after contracting by half a percentage point in 2023. Ministry of Finance expects Finland’s GDP to grow by 0.7 per cent in 2024 and by 2.0 per cent in 2025.

– Prefer to read this as PDF? Here it is.

Hietalahti market square, Helsinki. Photo by Laura Lumimaa.

Outlook for the Finnish economy and public finances

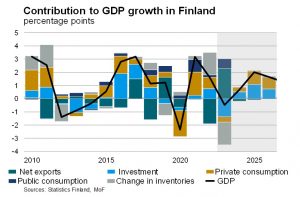

According to the latest economic forecast of the Ministry of Finance, Finland’s GDP will contract this year by 0.5 per cent. Finland’s economy has been weaker than expected in the latter part of the year with construction sector performing particularly poorly. However, slowing inflation and falling interest rates combined with increasing real earnings will turn GDP to growth next year. The Ministry’s downgraded estimate for GDP growth is 0.7 per cent in 2024, but growth is expected to strengthen to 2.0 per cent in 2025 and 1.6 per cent in 2026.

In 2023, exports from Finland will decline, but significantly less than imports. Net exports will therefore make a noticeably positive contribution to the economy this year. Finland’s cost-competitiveness is in good shape, and in 2024 exports are expected to grow by 2.0 per cent as world trade recovers.

With output decreasing particularly in construction, employment will fall slightly in 2024 but will increase again from 2025 onwards. In 2026, the employment rate for people aged 15-64 is expected to be close to 75% and the unemployment rate 6.6%. Employment growth will also be supported by the Government’s measures to increase labour supply, the first of which will take effect next year.

The general government deficit will be 2.5% of GDP in 2023. The deficit will grow to 3.5% in 2024, driven by weak economic and employment growth and slow growth in tax revenue. Contingency expenditure decided on earlier, large investments and the sharp increase in prices and wages will also keep expenditure growth brisk in the near future. The general government debt will stand at 79.1% in the end of next year. The estimate for the central government debt in 2024 is 58.5% in relation to GDP.

Source: Ministry of Finance: Economic Survey, Winter 2023.

Finland: COP28 deal “major step towards decarbonised world”

The deal that was agreed at the UN climate summit in Dubai calls on all countries to move away from using fossil fuels – but not to phase them out like many governments – including Finland – would have wanted. Even so, Finland sees the outcome of COP28 as a major step. In the new deal, countries agreed on tripling the production of renewable energy and doubling energy efficiency by 2030. According to the decision, all forms of clean energy will be taken into account as part of the energy transition, which matters to Finland as nuclear energy accounts for 26% of the energy mix.

Finland’s national target is carbon neutrality in 2035. Renewable energy already accounts for almost half of all energy used in Finland.

Review of Treasury operations by the State Treasury, October to December 2023

In Q4, the Republic of Finland conducted auctions of serial bonds and euro-denominated Treasury bills. The results of these auctions are summarised below.

| SERIAL BOND (RFGB) AND TREASURY BILL (RFTB) AUCTIONS IN Q4/2023 | |||||

| INSTRUMENT | AUCTION DATE | MATURITY | ISSUED AMOUNT (MEUR) | ISSUE YIELD | BID-TO-COVER |

| RFTB | 10 Oct 2023 | 14 May 2024 | 1,000 | 3.860% | 1.73 |

| RFTB | 10 Oct 2023 | 13 Aug 2024 | 1,000 | 3.830% | 1.60 |

| RFGB | 17 Oct 2023 | 15 Sep 2028 | 575 | 3.204% | 1.54 |

| RFGB | 17 Oct 2023 | 15 Sep 2033 | 685 | 3.422% | 1.22 |

| RFGB | 26 Oct 2023 | 4 Jul 2025 | 202 | 3.383% | 2.85 |

| RFGB | 26 Oct 2023 | 15 Sep 2027 | 39 | 3.177% | 10.49 |

| RFTB | 14 Nov 2023 | 14 May 2024 | 965 | 3.900% | 1.03 |

| RFTB | 14 Nov 2023 | 13 Aug 2024 | 1,003 | 3.770% | 1.47 |

| RFGB | 21 Nov 2023 | 15 Sep 2033 | 656 | 3.138% | 1.45 |

| RFGB | 21 Nov 2023 | 15 Apr 2036 | 270 | 3.285% | 2.19 |

| RFGB | 7 Dec 2023 | 15 Sep 2031 | 80 | 2.600% | 2.44 |

In addition to auctions, the tap window for Treasury bill issuance in EUR and USD-denominated bills was open in October and November. Issuance volumes in tap format were EUR 3.1 billion and USD 350 mio in respective currency with various maturities.

The budgeted gross borrowing in 2023 was EUR 39.259 billion, including EUR 11.221 billion of net borrowing. However, significant expenditure – some 4 billion euros – taking place on 2 Jan 2024 affects the borrowing requirement already for 2023. Additional borrowing to safeguard sufficient liquidity and a larger cash buffer at year end is thus required. This increase in the cash buffer raises the realised net borrowing to EUR 14.354 billion in 2023, resulting in gross borrowing of EUR 42.391 billion.

Near-term outlook for the period of January to March 2024 and beyond

The most recent forecast for 2024 by the Ministry of Finance includes a net borrowing requirement of EUR 12.879 billion. With redemptions of EUR 30.159 billion the gross borrowing requirement amounts to EUR 43.038 billion. The funding strategy of the Republic of Finland remains the same as in 2023 given the similarity in funding amounts.

Approximately 50% of the gross funding required will be funded in long-term maturities, and the rest will be covered with short-term Treasury bills. During 2024, three new euro benchmark bonds can be expected. The first euro benchmark bond syndication is expected to take place in the first quarter of the year.

In addition to a new 10-year benchmark the State Treasury aims to issue a new 30-year benchmark during 2024, market conditions permitting. The exact maturity for the third syndication will be subject to market conditions while aiming at a balanced redemption profile, thus either the 5-7-year or 15-year segments could be considered. As in previous years, issues under the EMTN programme can complement the euro-denominated benchmark funding during the year, market conditions permitting.

In addition to the new issues, auctions of existing euro benchmark bonds will be conducted. The State Treasury will publish a quarterly bond auction calendar for 2024. Auction dates together with target volumes are published quarterly in advance on our website: Serial bond auctions. The first auction will take place on 20 February. Full details of each auction are published a few days prior to the auction date post market consultation.

The auctions of euro-denominated Treasury bills in the first quarter of the year will take place on 9 January, 13 February and 12 March. The auctions will be arranged in the Bloomberg Auction System and are open to the RFTB dealer group. Further information on these auctions and a quarterly updated auction calendar will be published on our website: Treasury bill auctions.

In addition to Treasury bill auctions, a sporadic issuance window may open during the first quarter of the year. The timing is subject to the liquidity position and refinancing needs of the central government. Treasury bills are issued in euros and US dollars.

The next Quarterly Review will be published on 28 March 2024.

Further information: Teppo Koivisto, Director of Finance, tel. +358 295 50 2550 or Mika Tasa, Senior Manager at the Treasury Front Office, tel. +358 295 50 2552, firstname.lastname(at)statetreasury.fi