The Republic of Finland issued a new USD-denominated bond due 4 November 2030. The final issue size was USD 1.5 billion.

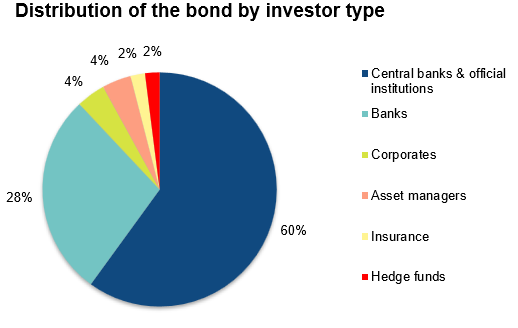

The bond attracted an order book in excess of USD 4 billion from over 60 investors.

The bond’s re-offer yield is 3.684%, which is 37 basis points above the mid-swap interest rate (USD SOFR) and 6.6 basis points over UST due 31 October 2030.

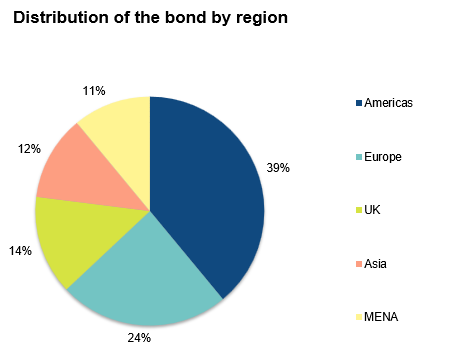

The USD-denominated bond complements the state’s euro-denominated borrowing. By issuing in USD, the Republic of Finland aims for investor diversification. With the new bond, this target was met with success and cost-efficiency.

“Thanks to market momentum and the strong order book, we were able to tighten the pricing by three basis points,” says Deputy Director Jussi Tuulisaari.

“Such a successful transaction demonstrates that Finland has broad access to global dollar markets, where we are regarded as a reliable and attractive borrower,” Tuulisaari concludes.

The issue was lead-managed by Barclays, HSBC, Nomura and Société Générale.

Details:

Issue amount: USD 1.5 billion

Pricing date: 28 October 2025

Settlement date: 4 November 2025

Coupon: 3.625%

Maturity: 4 November 2030

Price: 99.733

Yield: 3.684%

ISIN: XS3222747936 / US317873BJ59

Further information: Deputy Director Jussi Tuulisaari, tel. +358 295 50 2616, firstname.lastname(at)statetreasury.fi.