Summary:

– Long-term funding operations for 2025 are well advanced with all of the euro-denominated supply in syndicated form completed.

– Auction dates for Q4 have been published

– Government’s latest supplementary budget proposal for 2025 increased the net borrowing requirement to EUR 14.298 billion, which implies gross borrowing of EUR 43.753 billion.

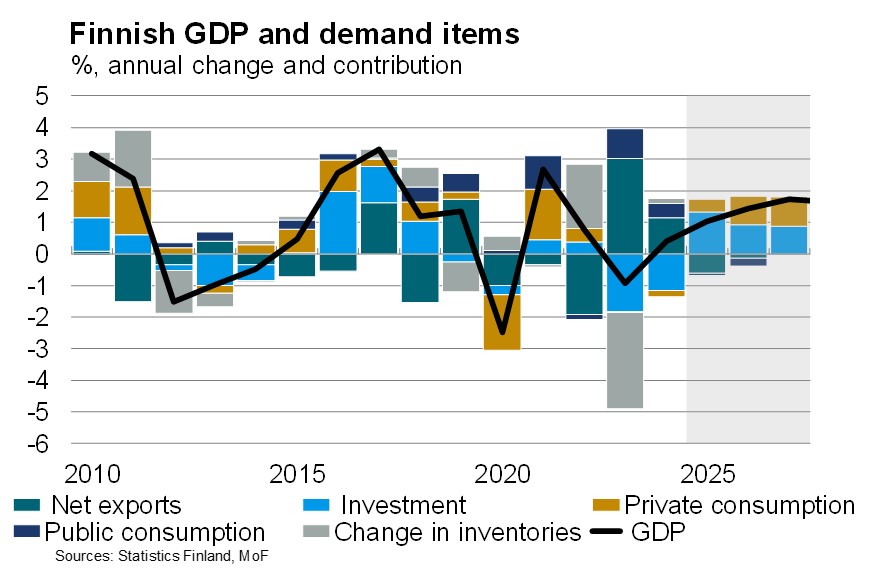

– Finland’s economic recovery has been slow as uncertainty and weak employment have driven households cautious. Ministry of Finance sees signs of faster grow ahead with GDP expected to grow by 1.0% this year, 1.4% next year and 1.7% in 2027.

– The general government debt-to-GDP ratio will rise to 87% this year. The debt ratio will temporarily stabilise in 2027.

– Prefer to read this as PDF? Here it is.

Photo: Pasi Markkanen

Outlook for the Finnish economy and public finances

Finland’s economic recovery has been slow, but in its latest forecast the Ministry of Finance sees signs of faster growth ahead. Slowing inflation and lower interest rates have boosted household purchasing power, but uncertainty and weak employment has so far caused households to steer their additional income into savings rather than consumption. Finland’s gross domestic product (GDP) is projected to grow around 1.0%, 1.4% next year and 1.7% in 2027. The forecast figures remain largely unchanged from the previous outlook, though the Ministry continues to view the level of uncertainty high.

Finnish export growth is affected by US trade policy and the appreciation of the euro, but is being supported by the euro area recovery. Investments will see a clear growth this year and are projected to grow faster in the outlook period of 2025-2027, driven significantly by energy transition and defence projects. Employment has not yet begun to grow, but an improvement is expected for 2026. Year-on-year, the number of employed persons is slightly lower than last year, while unemployment is substantially higher at 9.4%. The labour market has significant growth potential, with the workforce expanding due to government measures and immigration. However, weak demand has so far translated this growth into higher unemployment rather than increased employment.

The Ministry of Finance projects the general government deficit to be 4.3% of GDP this year, and the central government deficit to be 4.2% of GDP. Accelerating economic growth and the implementation of adjustment measures next year will improve general government finances, and the deficit will be 3.6% of GDP in 2026, eventually settling at 3.1% GDP in 2029. The general government debt-to-GDP ratio will rise to 87% this year, while the forecast for the central government debt ratio is 65.7%. In the forecast, the debt ratio will stabilise in 2027, but only temporarily. This autumn, the Finnish Parliament will discuss the debt brake, aiming for broad political consensus on long-term fiscal targets to curb public indebtedness across parliamentary terms.

Source: Ministry of Finance: Economic Survey, Autumn 2025

Annual Climate Report: Finland’s greenhouse gas emissions fell by 6% in 2024

Finland’s clean energy transition is progressing at a good pace, with energy sector emissions down 14% thanks to reduced coal and peat use and growth in wind and nuclear power. However, the net greenhouse gas emissions – the difference between emissions and the sinks that absorb them – fell by just 1% from the previous year. According to the Annual Climate Report 2025, reaching the climate neutrality target of 2035 will require more action in the effort sharing sector, and especially in the land use sector.

In 2025, Finland will revise its Climate Policy Plan and Energy Strategy to introduce new measures aimed at achieving Climate Act targets and meeting EU climate obligations.

Review of Treasury operations by the State Treasury, July to September 2025

On 20th August 2025, the Republic of Finland successfully launched a new EUR 4 billion RFGB benchmark due 15 April 2032. The bond was priced at 29 bps over mid-swaps, and the re-offer yield at issue was 2.751%. The syndication attracted strong demand from over 160 investors with the final order book closing in excess of EUR 33 billion. A broad mix of investors participated in the deal, led by banks and bank treasuries at 44%. Geographic distribution for the new bond was balanced across key regions such as the Nordics, UK, and Central Europe.

In Q3, the Republic of Finland conducted bond and Treasury bill auctions. Auction results are summarised below. These include an optional reverse inquiry (ORI) auction on 28 August to support the secondary market liquidity of off-the-run bonds.

In addition to auctions, the tap window for T-bill issuance in EUR denominated bills was open in August, producing EUR 2.428 billion of issuance with average maturity of 7.3 months.

| SERIAL BOND (RFGB) AND TREASURY BILL (RFTB) AUCTIONS IN Q3/2025 | |||||

| INSTRUMENT | AUCTION DATE | MATURITY | ISSUED AMOUNT (MEUR) | ISSUE YIELD | BID-TO-COVER |

| RFTB | 5 Aug 2025 | 13 Feb 2026 | 810 | 1.961% | 1.84 |

| RFTB | 5 Aug 2025 | 13 May 2026 | 1,170 | 1.966% | 1.80 |

| RFGB | 12 Aug 2025 | 15 Sep 2035 | 797 | 3.050% | 1.73 |

| RFGB | 12 Aug 2025 | 15 Sep 2040 | 702 | 3.411% | 1.83 |

| RFGB | 28 Aug 2025 | 15 Apr 2032 | 150 | 2.719% | 2.00 |

| RFGB | 28 Aug 2025 | 15 Apr 2052 | 250 | 3.694% | 1.78 |

| RFTB | 9 Sep 2025 | 13 May 2026 | 1,036 | 1.980% | 1.87 |

| RFTB | 9 Sep 2025 | 13 Aug 2026 | 965 | 1.990% | 2.03 |

| RFGB | 16 Sep 2025 | 15 Apr 2031 | 628 | 2.572% | 1.69 |

| RFGB | 16 Sep 2025 | 15 Sep 2035 | 874 | 3.067% | 1.48 |

Near-term outlook for the period of October to December 2025

The government’s third supplementary budget proposal for 2025 (dated 23 September) indicates a net borrowing requirement of EUR 14.298 billion which implies gross borrowing of EUR 43.753 billion. Long-term funding operations for 2025 are well advanced with all of the euro-denominated supply in syndicated form completed.

To complete the long-term funding requirement for the year, one or two more tap auctions of existing euro benchmark bond lines as well as two ORI auctions are expected to take place in Q4. The next bond auction will take place on 21 October. Please note that the November ORI auction will be held on 26 November, not on 27 November as previously announced. Further details on the auction and an updated auction calendar are published on: Serial bond auctions.

As in previous years, bonds may be issued under the EMTN programme to complement the funding in euro benchmark bonds during the year, market conditions permitting.

The next auctions of euro-denominated Treasury bills are expected to take place on 14 October and 11 November. The auctions will be arranged in the Bloomberg Auction System and are open to the RFTB dealer group. Further information and a quarterly updated auction calendar will be published on: Treasury bill auctions.

In addition to Treasury bill auctions, a tap issuance window for bills is likely to open during the last quarter of the year. The timing of the Treasury bill issuance is subject to the liquidity position and refinancing needs of the central government. Treasury bills are issued in euros and US dollars.

The next Quarterly Review will be published on 19 December 2025.

Further information: Director of Finance Anu Sammallahti, tel. +358 295 50 2575, or Senior Manager Mika Tasa at Treasury Front Office, tel. +358 295 50 2552, firstname.surname@statetreasury.fi