Summary:

– Finland’s estimated net borrowing requirement for 2026 is EUR 11.604 billion. With EUR 31.143 billion of redemptions the gross borrowing requirement amounts to EUR 42.747 billion.

– Approximately 60% of the next year’s gross funding will be funded with long-term maturities, the rest with Treasury bills.

– Three new euro benchmark bond syndications can be expected in 2026, out of which the first is likely to take place in Q1.

– Auction dates for Q1 have been announced. ORI auctions will continue with six dates announced for the whole of 2026.

– Finnish GDP will grow by just 0.2% this year as weak domestic demand has delayed economic recovery. Ministry of Finance expects Finland’s GDP to grow by 1.1% in 2026 and by 1.7% in 2027, driven by household consumption and investments.

– Prefer to read this as PDF? Here it is.

Outlook for the Finnish economy and public finances

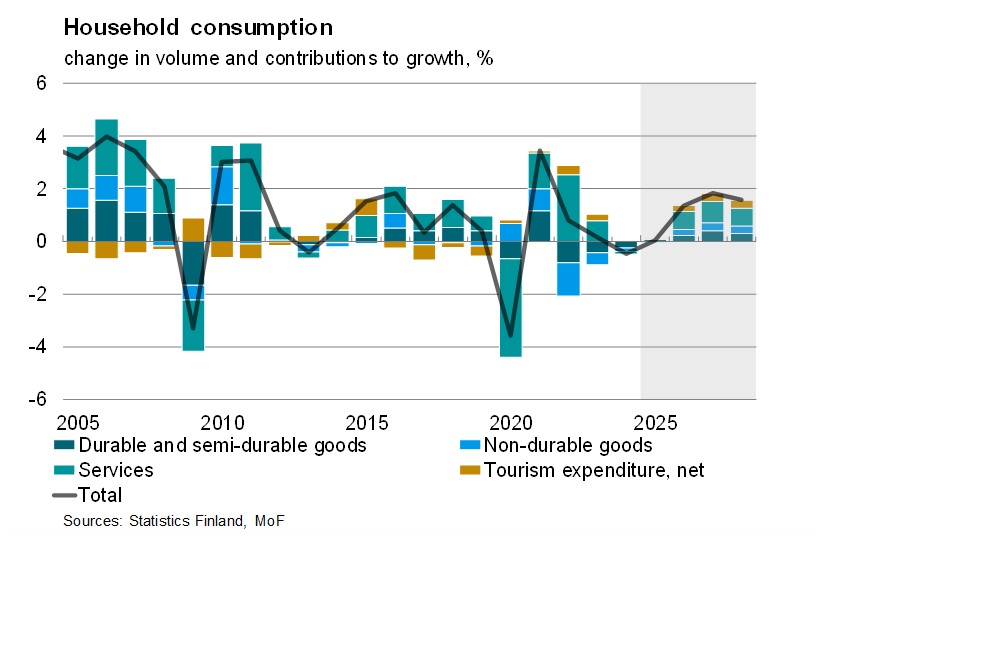

According to new forecast by the Ministry of Finance[1], Finland’s GDP growth will be only 0.2% this year as the economic recovery has been weaker than expected. Growth has been affected by lack of domestic demand as the uncertainties related to the labour market, geopolitical situation and fiscal austerity measures have undermined consumer confidence for an exceptionally long time. Factors supporting growth are nevertheless foreseen to be strong enough to accelerate the GDP growth to 1.1% in 2026, 1.7% in 2027 and 1.6% in 2028.

Growing employment, pay rises and lighter taxation of earned income will drive faster growth of household purchasing power in 2026. Inflation will also be moderate and remain below the euro area average. Household consumption will also be driven by the saving rate returning closer to normal from current high levels.

Housing construction is recovering slowly. Investments in production are being particularly driven by the energy transition, which is boosting investments in the production and transmission of electricity and in electricity-intensive production. Defence investments are also set to grow sharply starting next year. Finland’s exports are growing at pace with global demand.

Finland’s public finances have been under pressure since the COVID-19 pandemic. The general government deficit will be 3.9% of GDP in 2025, but the deficit is expected to widen to 4.5% in 2026, as the fighter jet purchases that had been expected in 2025 will be included in the next year’s deficit. Public debt will exceed 89% of GDP this year. The debt ratio is forecast to grow to 91.6% in 2026 and to 92.4% in 2027. A broad political consensus was reached in October on the new national fiscal framework, the “debt brake”, to curb public debt. The debt brake enables long-term balancing of public finances over parliamentary terms.

In 2026, the Republic of Finland will have a solicited credit rating from S&P Global Ratings. S&P has currently assigned an AA+ credit rating for Finland’s long-term debt. Calendar dates for the rating announcements in 2026 will be published on the State Treasury’s website after New Year.

[1] Economic Survey, Winter 2025

Finland’s national climate action assessed for investors

Finland’s climate policies and ambitions have been assessed again against the ASCOR framework, which is an investor-led initiative for making comparable assessments of sovereign debt issuers from a climate change perspective. The assessment shows that the early net-zero target (of 2035), carbon pricing, sectoral transition plans and effective adaptation planning are areas of strong performance. Finland has reduced its absolute emissions by an annual average of –5.6% over the past five years.

The countries assessed against the ASCOR framework in 2025 represent 90% of global greenhouse gas emissions and GDP, and 100% of three main sovereign bond market indices.

Review of Treasury operations, October to December 2025

On 29 October, the Republic of Finland raised 1.5 billion with a USD-denominated bond maturing on 4 November 2030. The bond attracted an order book in excess of USD 4 billion with 60 investors participating in the issue. The bond has a coupon of 3.625%, and re-offer yield at issue was 3.684%. USD-denominated issuance is launched under the Euro Medium Term Note issuance programme with the dual objective of investor base diversification as well as cost-efficient funding.

In Q4, the Republic of Finland conducted auctions of serial bonds and euro-denominated Treasury bills. The results of these auctions are summarised below.

| SERIAL BOND (RFGB) AND TREASURY BILL (RFTB) AUCTIONS IN Q4/2025 | |||||

| INSTRUMENT | AUCTION DATE | MATURITY | ISSUED AMOUNT (MEUR) | ISSUE YIELD | BID-TO-COVER |

| RFTB | 14 Oct 2025 | 13 May 2026 | 1,065 | 1.980% | 1.65 |

| RFTB | 14 Oct 2025 | 13 Aug 2026 | 935 | 1.976% | 2.12 |

| RFGB | 21 Oct 2025 | 15 Apr 2032 | 548 | 2.578% | 1.48 |

| RFGB | 21 Oct 2025 | 15 Sep 2035 | 869 | 2.936% | 1.40 |

| RFGB | 30 Oct 2025 | 15 Sep 2030 | 401 | 2.478% | 1.66 |

| RFTB | 11 Nov 2025 | 13 May 2026 | 800 | 1.970% | 2.57 |

| RFTB | 11 Nov 2025 | 13 Aug 2026 | 1,200 | 1.990% | 1.75 |

| RFGB | 18 Nov 2025 | 15 Sep 2035 | 778 | 3.014% | 1.30 |

| RFGB | 18 Nov 2025 | 15 Apr 2055 | 632 | 3.739% | 1.11 |

| RFGB | 26 Nov 2025 | 15 Sep 2030 | 205 | 2.474% | 2.59 |

| RFGB | 26 Nov 2025 | 15 Sep 2034 | 192 | 2.924% | 2.04 |

In addition to auctions, the tap window for Treasury bill issuance in EUR and USD-denominated bills was open in Q4. Issuance volumes were EUR 1.2 billion and USD 1.7 billion in respective currencies with various maturities.

In 2025, the realised central government borrowing exceeded the budgeted borrowing requirement by EUR 3.5 billion, driven mostly by the rise in cash collateral requirements over the course of the year. The increase in cash collateral requirements was due both to changes in interest rates – particularly the steepening of the yield curve – and to the strengthening of the euro against the dollar. Adjusted for the rise in cash collateral requirements, the realised net borrowing of 2025 was EUR 17.804 billion, resulting in gross borrowing of EUR 47.259 billion.

Near-term outlook for the period of January to March 2026 and beyond

The budget proposal for 2026 by the Ministry of Finance includes a net borrowing requirement of EUR 11.604 billion. With redemptions of EUR 31.143 billion, the gross borrowing requirement amounts to EUR 42.747 billion. The funding strategy of the Republic of Finland remains the same as in 2025 given the similarity in funding amounts.

Approximately 60% of the gross funding required will be funded in long-term maturities, and the rest will be covered with short-term Treasury bills. During 2026, three new euro benchmark bonds can be expected. The first euro benchmark bond syndication is expected to take place in the first quarter of the year.

In terms of bond maturities, the 10-year and 5-7 year benchmark bond maturities will be complemented by a longer maturity benchmark bond, likely to be a 15-year. The exact maturity of the long bond will be subject to market conditions with the State Treasury aiming for a balanced bond curve with liquid 15-, 20-, and 30-year maturity lines. As in previous years, issues under the EMTN programme can complement the euro-denominated benchmark funding during the year, market conditions permitting.

Auctions of existing euro benchmark bonds will be conducted in 2026. Auction dates together with target volumes are published quarterly in advance on our website: Serial bond auctions. The first auction will take place on 17 February. Full details are published a few days prior to the auction date post market consultation. ORI (Optional reverse inquiry) auctions to support the secondary market liquidity of off-the-run bonds will continue with six calendar dates for 2026 now published.

The auctions of euro-denominated Treasury bills in the first quarter of the year will take place on 7 January, 10 February and 10 March. The auctions will be arranged in the Bloomberg Auction System and are open to the RFTB dealer group. Further information and a quarterly updated auction calendar will be published on our website: Treasury bill auctions.

To complement Treasury bill auctions, a sporadic issuance window may open during the first quarter of the year. The timing is subject to the liquidity position and refinancing needs of the central government. Treasury bills are issued in euros and US dollars.

The next Quarterly Review will be published on 31 March 2026.

Further information: Anu Sammallahti, Director of Finance, tel. +358 295 50 2575, or Jussi Tuulisaari, Head of Funding, tel. +538 295 50 2616, firstname.lastname(at)statetreasury.fi