Summary:

– State Treasury is planning to issue a new euro benchmark bond in Q3, likely in the 5-7 year sector.

– Auction dates for Q3 have been announced.

– At the end of Q2, approximately 62% of foreseen long-term funding has been completed.

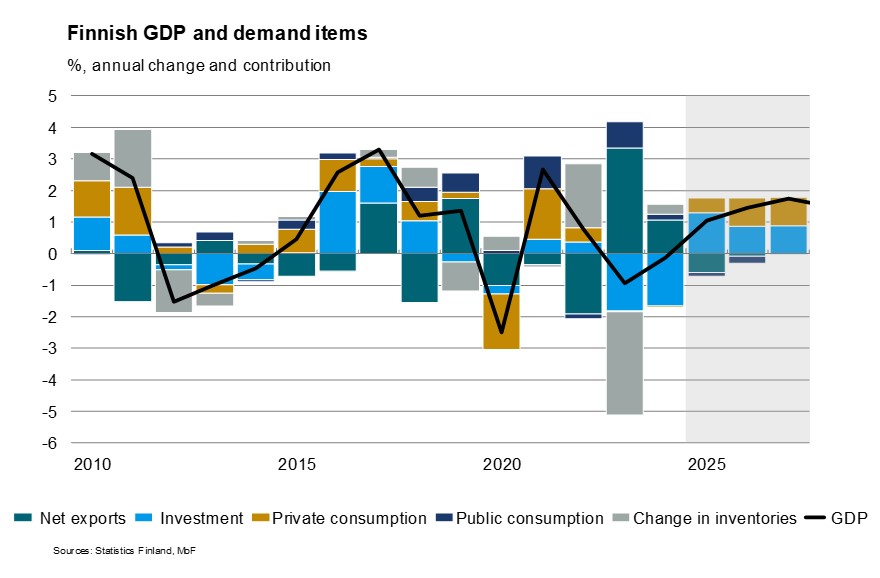

– The economy is recovering though outlook is dampened by global economic uncertainty and trade tensions. Finland’s GDP is projected to grow by 1.0% in 2025 and, 1.5% in 2026 and 1.7% in 2027.

– Finland intends to increase defence spending to 3% of GDP by 2029 and, as part of NATO alliance, to 5% of GDP by 2035.

– Finland remains world leader in progress towards the Sustainable Development Goals.

– Prefer to read this as PDF? Here it is.

Photo by: Pasi Markkanen / Finland Image Bank

Outlook for the Finnish economy and public finances

Finland’s economy is recovering, but the outlook is overshadowed by trade disputes and uncertainty. The economy turned to growth last year (with GDP figures from 2024 recently revised from -0.1% to 0.4%), and there have been positive developments since. With slow inflation, lower interest rates and wages increasing, household purchasing power is improving. Investments are expected to grow quickly, driven by the energy transition, defence investments, and a gradual recovery in the housing market. With the assumption that US import tariffs of around 10% will remain in place, Finland’s GDP will grow by 1.0% this year, 1.5% next year and 1.7% in 2027.

Despite the projected growth, public finances will remain in deficit though fiscal balance is expected to begin to improve this year. The Ministry of Finance estimates the general government deficit to be 4.2% of GDP this year, followed by 3.6% in 2026 and 3.5% in 2027. Geopolitical instability and subdued economic performance have affected central government revenue and expenditure for some time. The Finnish government announced a significant growth package and increases to defence spending in its mid-term policy review in April, which will increase the central government deficit in particular, but they will also boost economic activity. The general government debt-to-GDP ratio will rise by over 86% this year, after which the fastest growth in debt is over for the time being. Given the broad political consensus on improving Finland’s debt sustainability, the Government has just launched a parliamentary debate on a national debt brake.[1]

Finland is committed to increasing defence spending to at least 3% of GDP by 2029. This will mean an increase of defence expenditure by EUR 0.6 billion in 2028 and by EUR 3.0 billion in 2029, compared to the level decided earlier. For 2026–2027, the level of defence appropriations is already secured. [2] Going forward, Finland will – as part of the NATO alliance – further increase its defence spending to 5% of GDP by 2035 with 3.5% directly on defence and a further 1.5% on defence-related infrastructure.

[1] Ministry of Finance: Economic Survey, Summer 2025

[2] Numbers from the Budget Department, Ministry of Finance

World leader in progress towards Sustainable Development Goals.

Finland ranks first globally in the SDG Index with a total score of 87.02, according to the Sustainable Development Report 2025. Finland has just submitted its third Voluntary National Review 2025 (VNR) to the UN, together with the Finnish government’s own review of its progress in implementing the 2030 Agenda for Sustainable Development.

Review of Treasury operations by the State Treasury, April to June 2025

A new euro benchmark bond – the second syndicated transaction of the year – was launched on 29 April. The new 10-year bond maturing on 15 September 2035 with an issue size of EUR 4 billion was priced at 52 basis points over the euro swap curve. Over 150 investors participated in the issue. The bond has a coupon of 3%, and yield at issue was 3.016%.

In Q2, the Republic of Finland conducted bond and Treasury bill auctions. The auction results are summarised below. These include two optional reverse inquiry (ORI) auctions – on April 3 and June 26 – to support the secondary market liquidity of off-the-run bonds.

In addition to auctions, the tap window for T-bill issuance in USD denominated bills was open in May and June, producing 4.25 billion of issuance with an average maturity of 6.8 months. In addition, 200 million of EUR denominated T-bills were sold in June.

| SERIAL BOND (RFGB) AND TREASURY BILL (RFTB) AUCTIONS IN Q2/2025 | |||||

| INSTRUMENT | AUCTION DATE | MATURITY | ISSUED AMOUNT (MEUR) | ISSUE YIELD | BID-TO-COVER |

| RFGB | 3 Apr 2025 | 15 Sep 2027 | 103 | 2.100% | 8.50 |

| RFGB | 3 Apr 2025 | 4 Jul 2042 | 301 | 3.390% | 1.53 |

| RFTB | 8 Apr 2025 | 13 Nov 2025 | 845 | 2.130% | 1.42 |

| RFTB | 8 Apr 2025 | 13 Feb 2026 | 1,150 | 2.100% | 1.09 |

| RFGB | 15 Apr 2025 | 15 Sep 2031 | 680 | 2.600% | 1.57 |

| RFGB | 15 Apr 2025 | 15 Apr 2055 | 820 | 3.470% | 1.17 |

| RFTB | 13 May 2025 | 13 Nov 2025 | 885 | 2.030% | 1.99 |

| RFTB | 13 May 2025 | 13 Feb 2026 | 1,116 | 2.010% | 1.77 |

| RFGB | 20 May 2025 | 15 Sep 2032 | 722 | 2.702% | 1.59 |

| RFGB | 20 May 2025 | 15 Sep 2035 | 780 | 3.011% | 1.86 |

| RFTB | 3 Jun 2025 | 13 Feb 2026 | 874 | 1.920% | 2.14 |

| RFTB | 3 Jun 2025 | 13 May 2026 | 1,126 | 1.907% | 1.67 |

| RFGB | 10 Jun 2025 | 15 Sep 2032 | 733 | 2.677% | 1.53 |

| RFGB | 10 Jun 2025 | 15 Apr 2043 | 758 | 3.365% | 1.63 |

| RFGB | 26 Jun 2025 | 15 Sep 2030 | 225 | 2.432% | 2.64 |

| RFGB | 26 Jun 2025 | 15 April 2052 | 175 | 3.427% | 3.86 |

Near-term outlook for the period of July to September 2025

In the government budget, the net borrowing requirement for 2025 is EUR 13.233 billion. The gross borrowing amount in 2025 is EUR 42.688 billion. At the end of Q2, approximately 62% of foreseen long-term funding has been completed.

The State Treasury is planning to issue a new euro benchmark bond in Q3, likely in August – September. A potential maturity of the bond is foreseen in the 5-7 year sector.

The next bond auction will take place on 12 August. Further details and an updated auction calendar are published on: Serial bond auctions. The auction calendar for Q3 includes an optional serial bond auction (ORI) on 28 August.

As in previous years, bonds may be issued under the EMTN programme to complement the funding in euro benchmark bonds during the year, market conditions permitting.

The next auctions of euro-denominated Treasury bills will take place on 5 August and 9 September. The auctions will be arranged in the Bloomberg Auction System and are open to the RFTB dealer group. Further information and a quarterly updated auction calendar are published on: Treasury bill auctions.

In addition to auctions, an issuance window for bills is likely to open during the second half of the year. The timing of the Treasury bill issuance is subject to the liquidity position and refinancing needs of the central government. Treasury bills are issued in euros and US dollars.

The next Quarterly Review will be published on 30 September 2025.

Further information: Director of Finance Anu Sammallahti at the Treasury Front Office, tel. +358 295 50 2575, firstname.lastname(at)statetreasury.fi