The Republic of Finland raised EUR 4 billion with a new benchmark bond maturing on 15 April 2032. The bond was priced at 29 bps over the euro swap curve.

The bond attracted an order book of record-breaking EUR 33 billion from 160 investors, signaling strong investor confidence in Finland.

“Investor demand was also supported by the successful timing of the transaction, during which there was very little competing supply. This bolstered the visibility and demand for the bond, and enabled us a swift execution”, Deputy Director Jussi Tuulisaari says.

“The market appeared constructive after the summer break, as the few recent issuances and Finland’s own auction in early August were heavily subscribed. We therefore expected strong demand.”

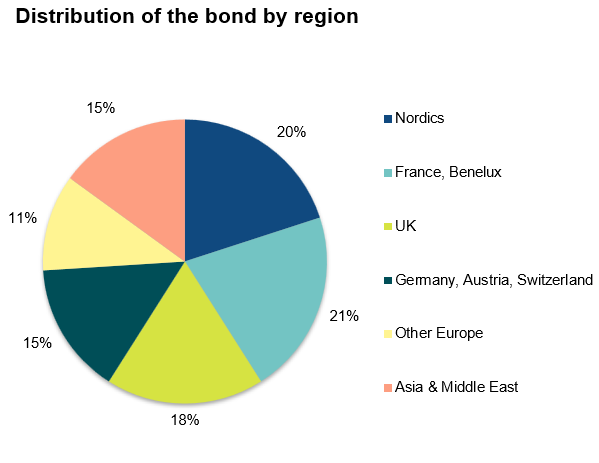

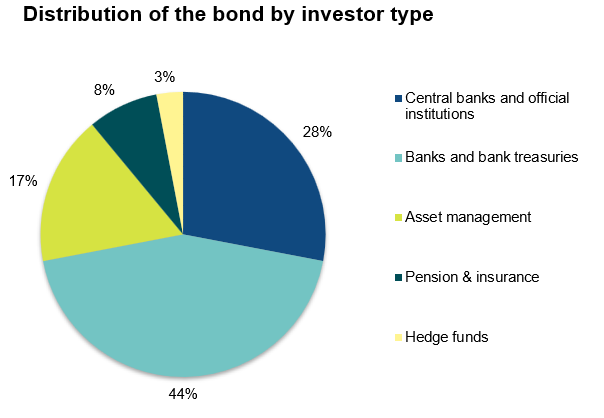

The record book size and the high proportion of long-term investors made it possible to upsize the deal from EUR 3 billion to EUR 4 billion. Of the new bond, just over 40% was allocated to banks and bank treasuries, and 30% to central banks and official institutions. Geographic distribution for the new 7-year bond was balanced across key regions such as the Nordics, the UK, and Central Europe.

The issue was lead-managed by Barclays, BofA Securites, Danske Bank, Deutsche Bank and J.P. Morgan. The other primary dealers were also included in the syndicate group.

Details:

Issue amount: EUR 4 billion

Pricing date: 20 August 2025

Payment date: 28 August 2025

Maturity: 15 April 2032

Coupon: 2.625%

Price: 99.254

Yield: 2.751%

ISIN Code: FI4000591862

Further information: Deputy Director Jussi Tuulisaari, tel. +358 295 50 2616, firstname.lastname(at)statetreasury.fi

*Press release corrected on Friday, 22 Aug. Total order book size was over EUR 33 billion, not EUR 32 billion.