The Republic of Finland raised EUR 3 billion with a new benchmark bond maturing on 15 April 2041. The bond attracted an order book of EUR 25 billion from more than 160 investors.

The orderbook filled quickly in both size and quality, enabling efficient pricing and balanced allocations. Amid a week of market-moving headlines, this was welcome news.

“Headlines from around the world have shaken the markets, and uncertainty has pushed government bond yields higher across the board this week. Despite the noise, investor demand for the new 15‑year bond was actually the strongest ever for our issuance in this maturity,” says Deputy Director Jussi Tuulisaari.

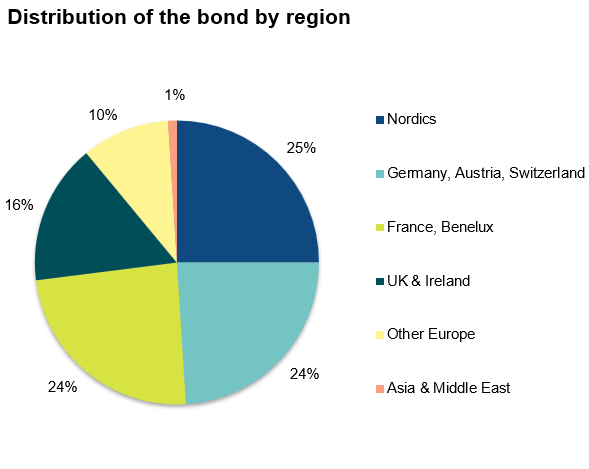

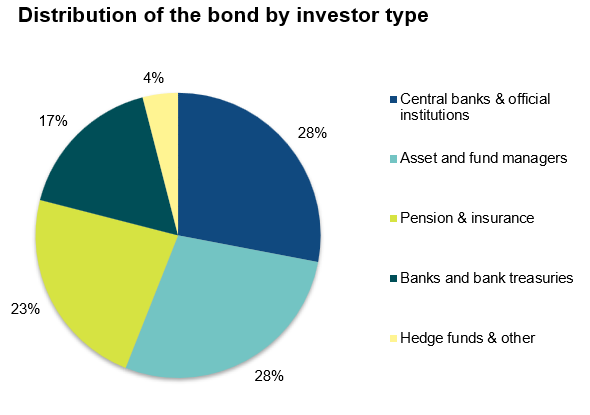

Of the new bond, the largest shares – 28% – were placed with central banks & official institutions and asset managers, while 23% was allocated to pension funds and insurance companies. Geographically, the strongest demand came from the Nordic countries, Central Europe, and from France and the Benelux region, which together accounted for nearly three quarters of the allocation.

The bond was priced at 47 bps over mid-swaps and 34.3 bps over the DBR 2.6% May 2041.

The issue was lead-managed by Barclays, BNP Paribas, Danske Bank, Deutsche Bank and J.P. Morgan. The other primary dealers were also included in the syndicate group.

Details:

Issue amount: EUR 3 billion

Pricing date: 21 January 2026

Payment date: 28 January 2026

Maturity: 15 April 2041

Coupon: 3.550%

Price: 99.594

Yield: 3.586%

ISIN Code: FI4000598776

Further information: Deputy Director Jussi Tuulisaari, tel. +358 295 50 2616, firstname.lastname(at)statetreasury.fi