The Republic of Finland raised EUR 4 billion with a new benchmark bond maturing on 15 September 2035. The bond attracted an order book in excess of EUR 23 billion from over 150 investors.

The bond was priced at 52 bps over the euro swap curve. The orderbook was multiple of issue size, signaling strong demand for the new benchmark.

“Against the backdrop of significant volatility in many markets recently, Finland’s 10-year benchmark is a standard product that caters well for a wide range of investors and sells well despite turbulence. This, of course, applies to all eurozone government bonds,” Director of Finance Anu Sammallahti said.

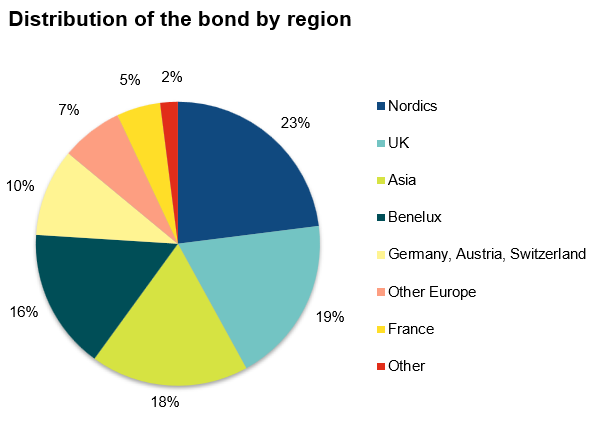

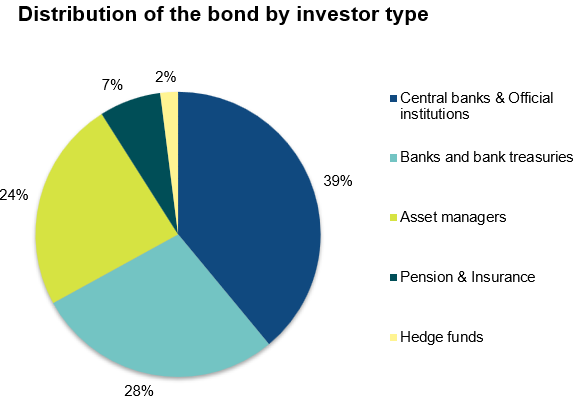

The order book reflects not only quantity but also quality and balance. Nearly 40% of the bond was allocated to central banks and official institutions. Geographically, the largest portion of the bond (over 20%) was sold to Nordics.

“Interest from our domestic and neighbouring Nordic investors appears to be increasing compared to previous years,” Sammallahti observed.

The issue was lead-managed by BNP Paribas, Citi, Crédit Agricole CIB, Goldman Sachs Bank Europe SE and Nordea. The other primary dealers were also included in the syndicate group.

Details:

Issue amount: EUR 4 billion

Pricing date: 29 April 2025

Payment date: 7 May 2025

Maturity: 15 September 2035

Coupon: 3.000%

Price: 99.870

Yield: 3.016%

ISIN Code: FI4000587415

Further information: Director of Finance Anu Sammallahti, tel. +358 295 50 2575, firstname.lastname(at)statetreasury.fi