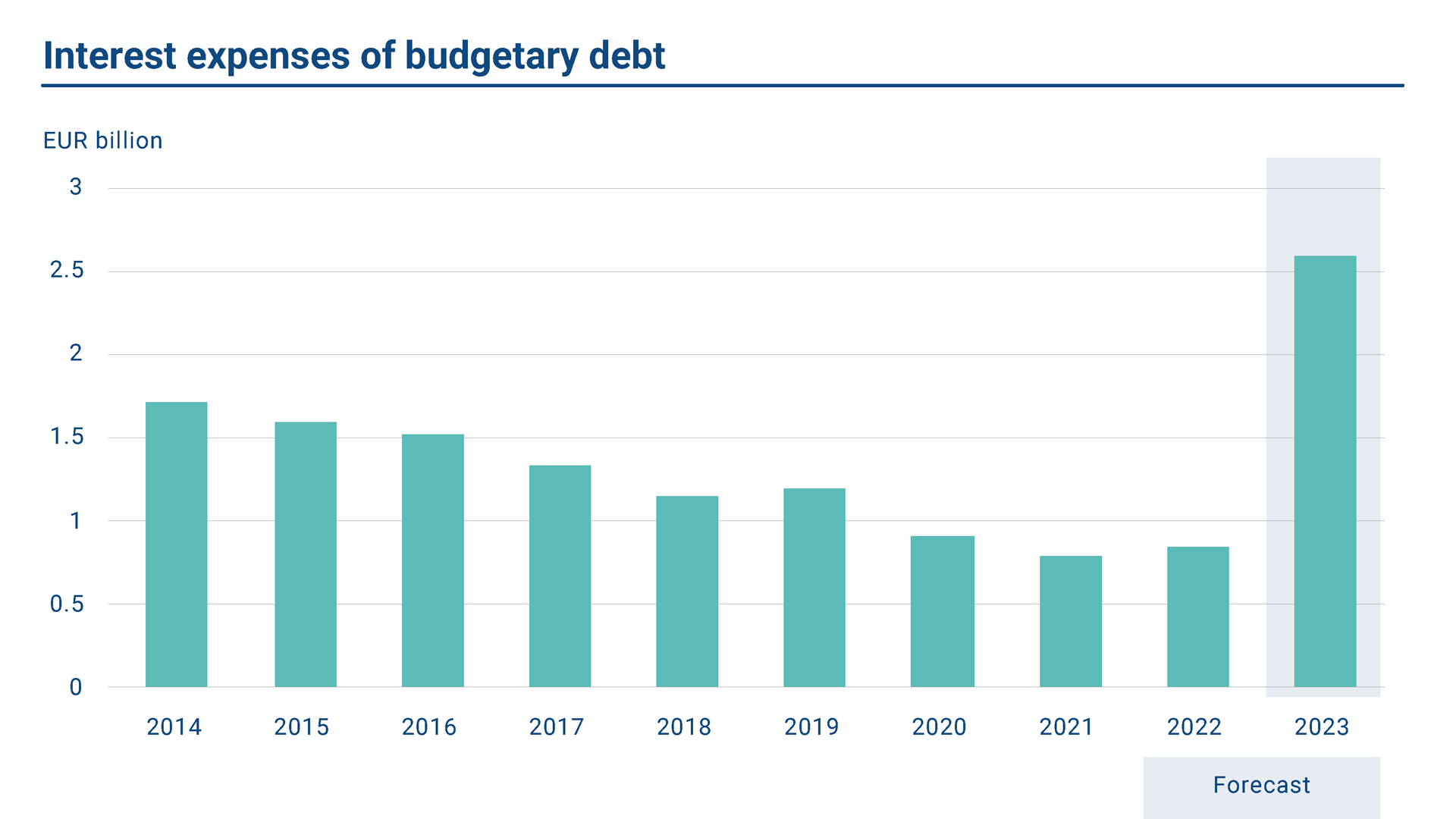

The objective of Finland’s central government debt management is to carry out its funding requirements while minimising the financing cost over the long term, and taking account of risk.

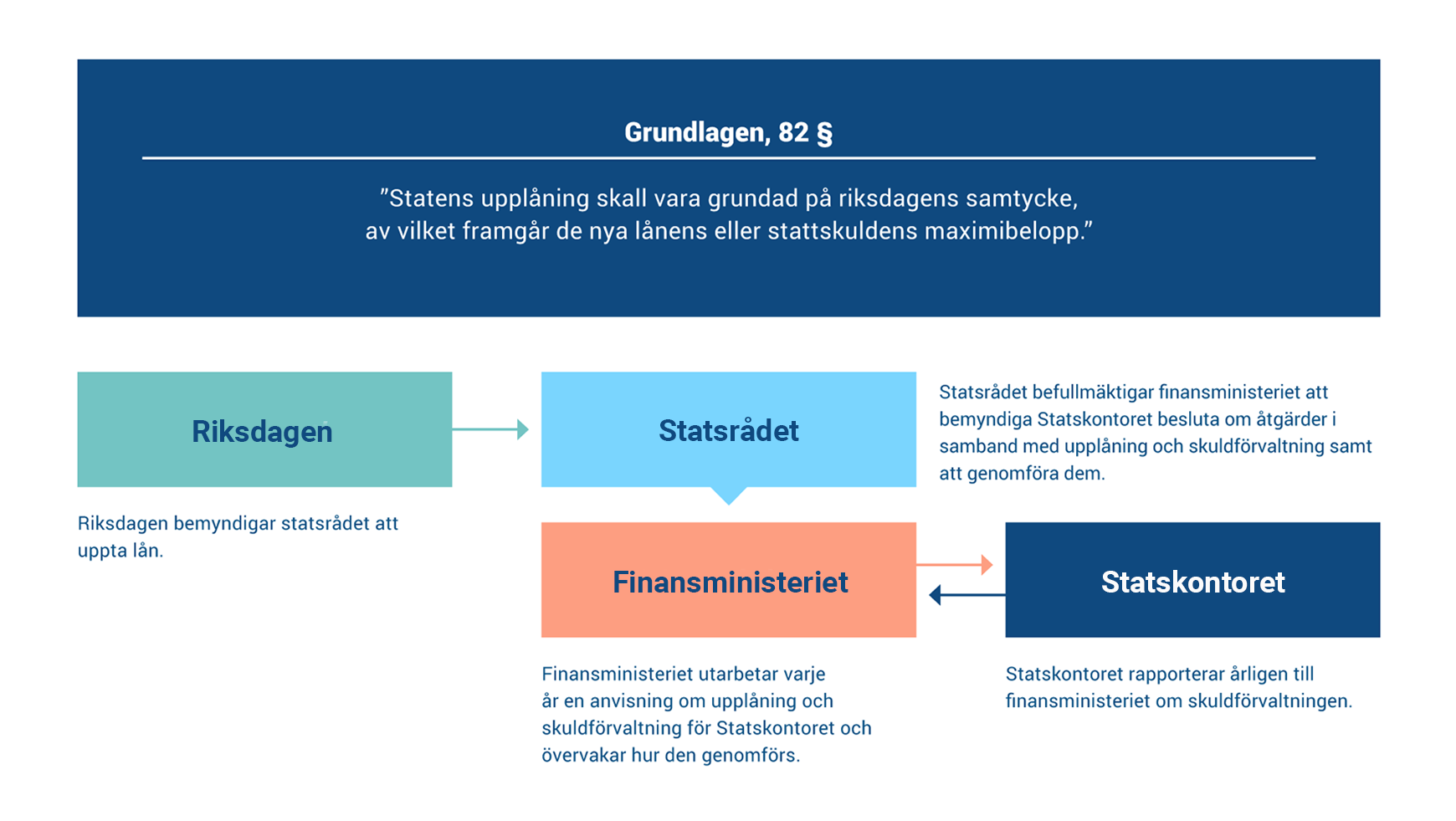

Debt management framework

The general principles and objectives of central government debt management are determined by the Ministry of Finance. The State Treasury is a central administrative agency operating under the Ministry of Finance, and implements all debt management operations under the guidelines set by the Ministry.

The Ministry’s guidelines set out the general principles and objectives of debt management, instruments used in debt management, and risk limits as well as other restrictions that must be observed. The State Treasury is authorised to raise funds, provided that the nominal value of the central government debt does not exceed EUR 150 billion until further notice and that, at the time of borrowing, the amount of short-term debt does not exceed EUR 25 billion.

The State Treasury is authorised to take out short-term loans when necessary to safeguard the central government’s liquidity. The State Treasury can also enter into derivative contracts when managing the risks, in accordance with guidelines set by the Ministry of Finance.

The State Treasury reports regularly on debt management to the Ministry of Finance. The government submits financial statements to Parliament annually, including an overview of the state of the national economy.

Risk management principles

Risk management is an integral part of sound debt management. The objective of risk management is to avoid unexpected losses and safeguard the continuation of operations. The government’s objective is to manage all risks in a systematic manner. The risk management process consists of identification of risks, quantification and evaluation of risks, risk monitoring and reporting, and active management of risk positions.

The main risks are financing risk (long-term refinancing and short-term liquidity risk), market risk (interest rate risk and exchange rate risk), credit risk, operational risk and legal risk.

Financing risk

The purpose of Finland’s central government’s borrowing is to fulfil the government’s financing needs in such a way that the cost-efficient management of financial commitments is safeguarded under all circumstances, and the risks associated with financial operations are controlled. Funding is implemented primarily through long-term benchmark bonds and short-term Treasury bills.

Short-term liquidity risk (i.e. risk below 12 months) is managed by short-term funding and maintaining an invested liquidity buffer. Liquidity management is based on cash flow forecasts covering the entire government administration. The Ministry of Finance has set limits on the magnitude of uncovered net cash flows. When investing the surplus, the government aims to minimise credit risk, e.g. via collateralised investments. The short-term funding instruments are short-term credits as well as Treasury bills denominated in both euros and US dollars.

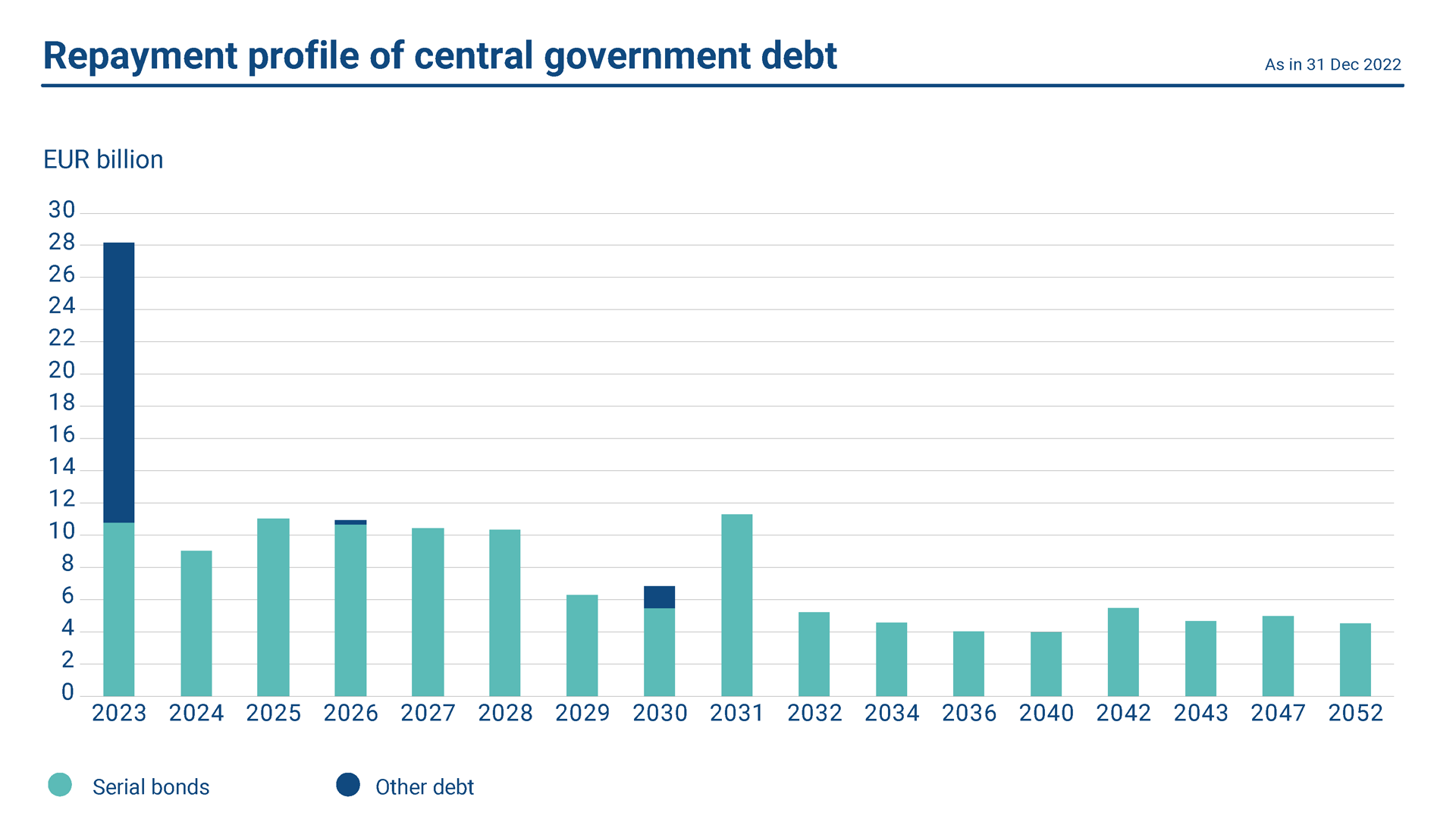

In order to manage the long-term refinancing risk, the Finnish government diversifies its funding by instruments, investor type and geographic areas and manages the maturity profile of the debt. The foundation of government funding is built upon benchmark bonds that facilitate funding even in extensive volumes. The government launches new benchmark bonds in medium- and long-term maturities via syndication. The issuance strategy strives towards a smooth redemption profile and avoids concentrations in redeeming debt.

Market risks

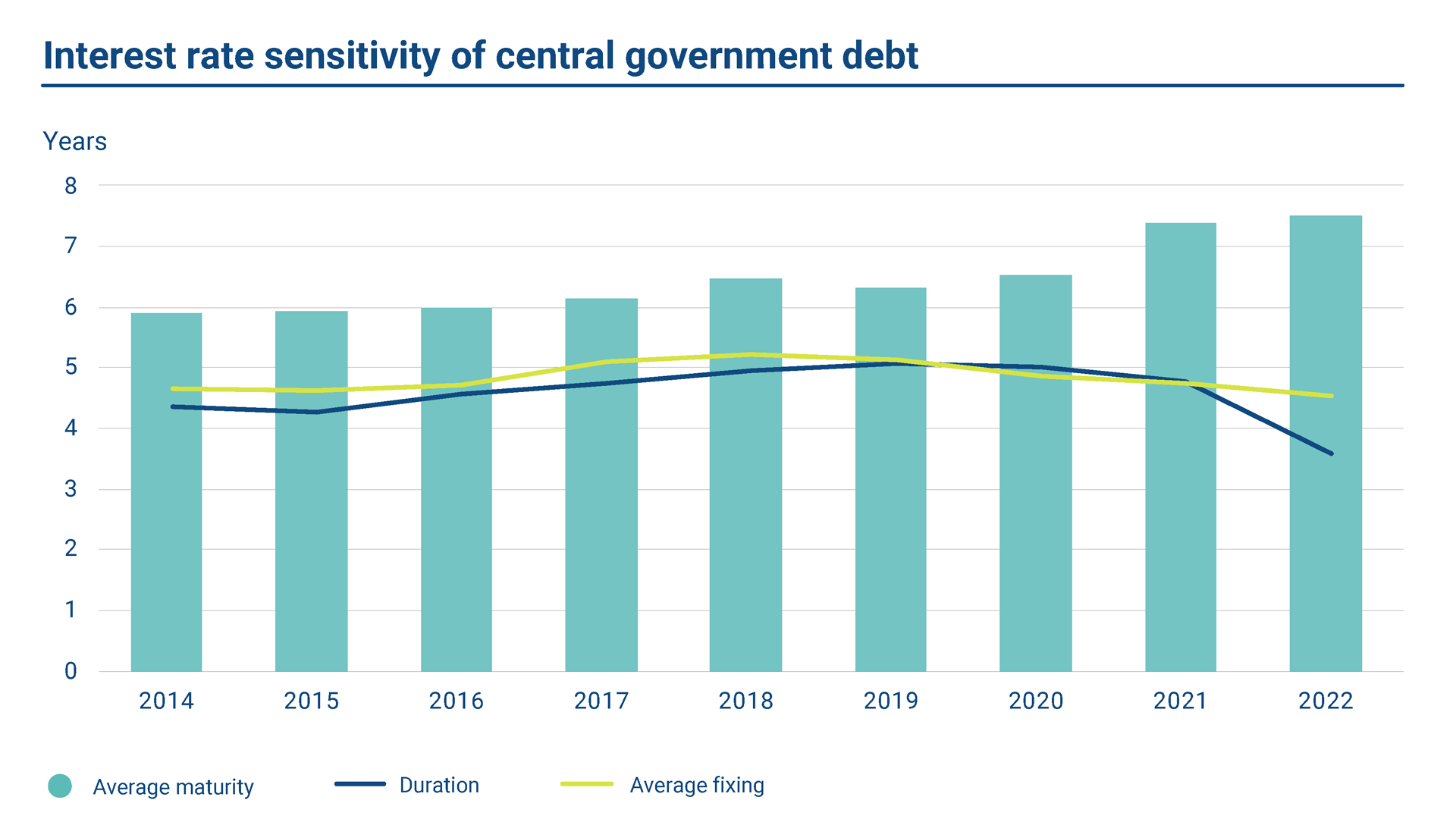

Concerning interest rate risk, the strategic target of the government is expressed in the form of a benchmark portfolio. The benchmark portfolio enables the government to evaluate the performance of operative debt management carried out by the State Treasury. The targeted interest rate risk profile is defined in terms of average fixing (the average period of repricing/refixing the debt).

The State Treasury is allowed to deviate from the benchmark’s risk profile within the limits set in the guidelines of the Ministry of Finance. The difference between the relative costs of the actual debt portfolio and the benchmark portfolio constitutes the result of the State Treasury’s debt management. In order to fine-tune the government’s interest rate risk exposure, the State Treasury uses derivatives, mainly interest rate swaps. At the end of 2022, the average fixing of the central government debt was 4.53 years (duration 3.57 years). The average fixing was almost unchanged from 2021, but duration (i.e. discounted cash-flow weighted maturity) was affected by sharply rising interest rates. As rates rose, the discounted present value of coupons and redemptions fell thus shortening debt portfolio duration.

The central government takes no exchange rate risk in its new debt management operation. There was no open exchange rate risk relating to the old debt outstanding at the end of 2022.

Credit risk

Credit risk results from investment of cash funds and derivative positions. Credit risk is managed through limits and increasingly through collateral with respect to both derivatives and cash investments. The issue of credit risk is especially relevant due to the large amount of cash funds. The government requires high credit ratings of its counterparties and the guidelines of the Ministry of Finance stipulate counterparty limits in accordance with these credit ratings. To reduce credit risk associated with cash investments, the State Treasury places funds, e. g. via collateralised investments in the form of triparty repo transactions.

Long-term credit risk resulting from derivative transactions is mitigated by the State Treasury through collateral. Like many other sovereign borrowers, Finland uses collateral agreements under the ISDA agreements (CSA, Credit Support Annex). The agreements are two-way agreements with some minor exceptions, i.e. both counterparties have an obligation to pledge collateral.

Operational risk

Operational risk is defined as a risk that results from external factors, technology, or deficient functioning of personnel, the organisation or processes. One area that needs special attention is information security including the security of documents as well as the security of IT systems. Another focal point is development and continuous testing of operational continuity plans. Periodic audits by external cybersecurity experts have also spurred improvements in operative processes.

The principles of operational risk management are implemented in the daily operations. Descriptions of realised risk events and close calls are compiled and reported to management. The State Treasury monitors the risk factors and risk events on a regular basis and makes risk assessments.

Legal risk

Legal risk is the risk resulting from failure to comply with laws and regulations or established market practices as well as invalidity, nullity, voidability, discontinuation or the lack of documentation of contracts, agreements and decisions. The State Treasury has internal guidelines for the management of legal risk. The objectives of legal risk management are to ensure compliance with applicable laws, rules and regulations and to minimize legal risk by utilising standard agreements and the government’s own templates. In addition, steps are taken to ensure that employees are familiar with legislation, regulations and market practices concerning their activities.

Internal control

Internal control is an integral part of management of the State Treasury. The aim of internal control is to reach reasonable assurance that operational functions are effective and efficient, internal and external reporting is reliable and laws and regulations are complied with. A sound system of internal control helps all parts of the organisation to reach their targets.

As part of internal control all main debt management processes are evaluated on an annual basis. The assessment pays special attention to the clarity of objectives, risks and control procedures.