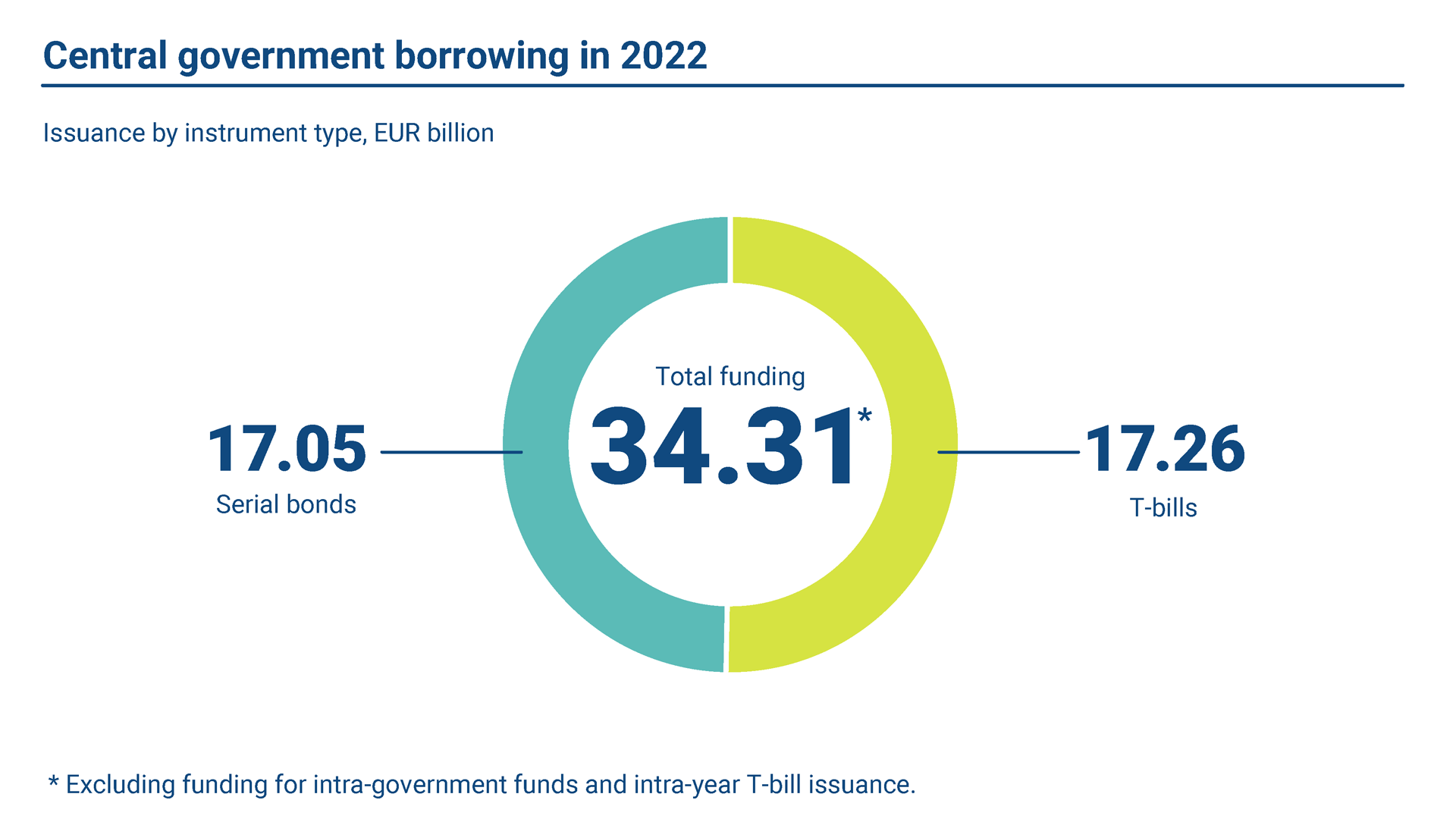

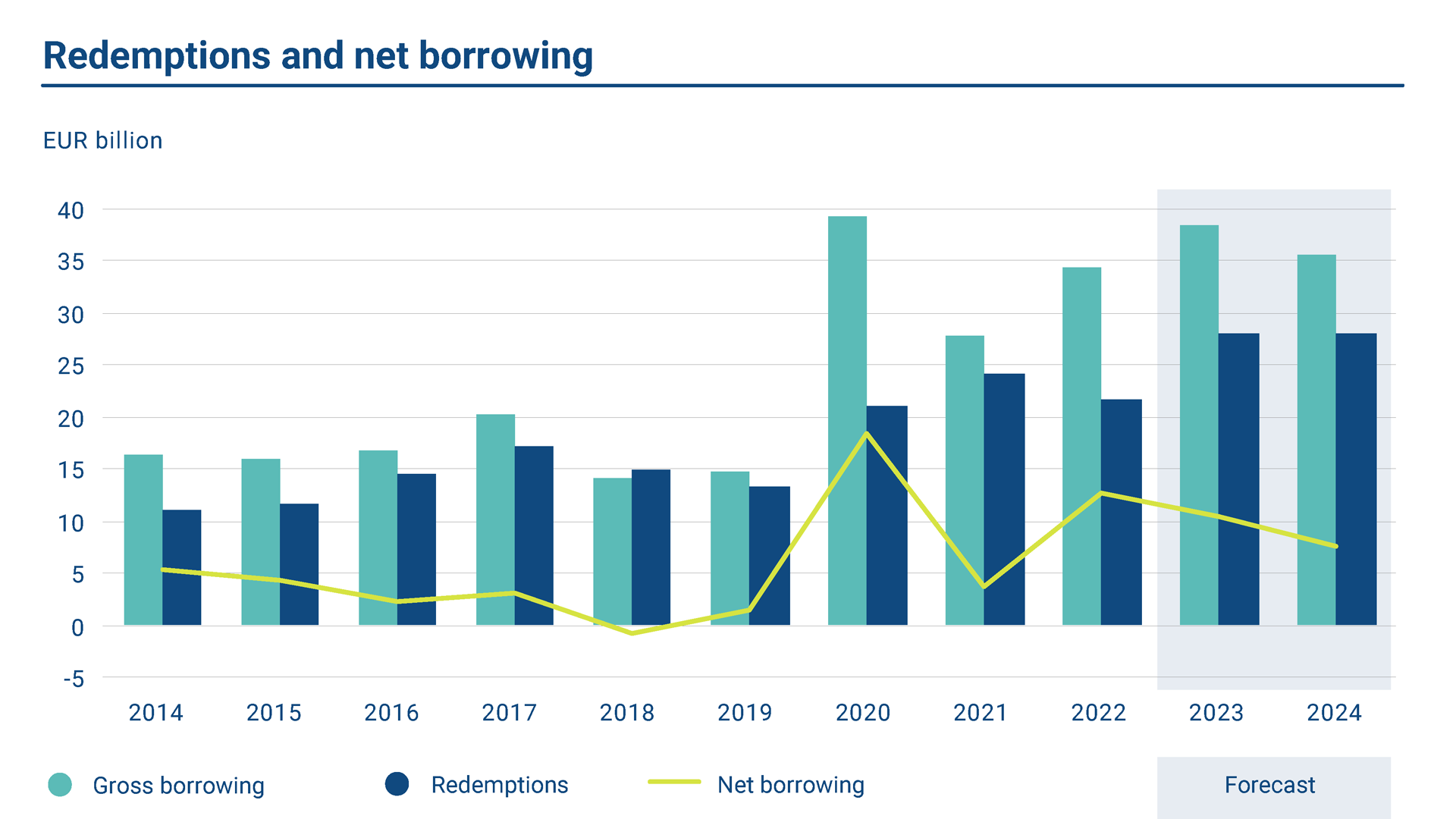

In 2022, the realised gross borrowing totaled EUR 34.31 billion. Of this amount, long-term issuance accounted for EUR 17.05 billion. The rest, EUR 17.26, was short-term borrowing. In the coming years, the gross borrowing requirement is estimated to follow this year’s pattern and to remain around EUR 35–40 billion annually.

Finland’s GDP growth was brisk in the first half of 2022, but growth was dragged down towards the end of the year. The Finnish economy proved surprisingly resilient during the exceptional times. The general government budgetary position was supported by nominal growth of the economy, and high employment.

The budgeted gross borrowing in 2022 was EUR 40.944 billion, including EUR 19.306 billion of net borrowing. This net borrowing estimate included funding a EUR 10 billion lending facility for eligible energy companies’ electricity market margin calls. No such funding was required as no loans were drawn, or even applied for, under this facility during 2022. However, collateral needs related to interest rate swaps executed for interest rate risk management raised the borrowing requirement. Such collateral posted is an interest-bearing asset on the government balance sheet.

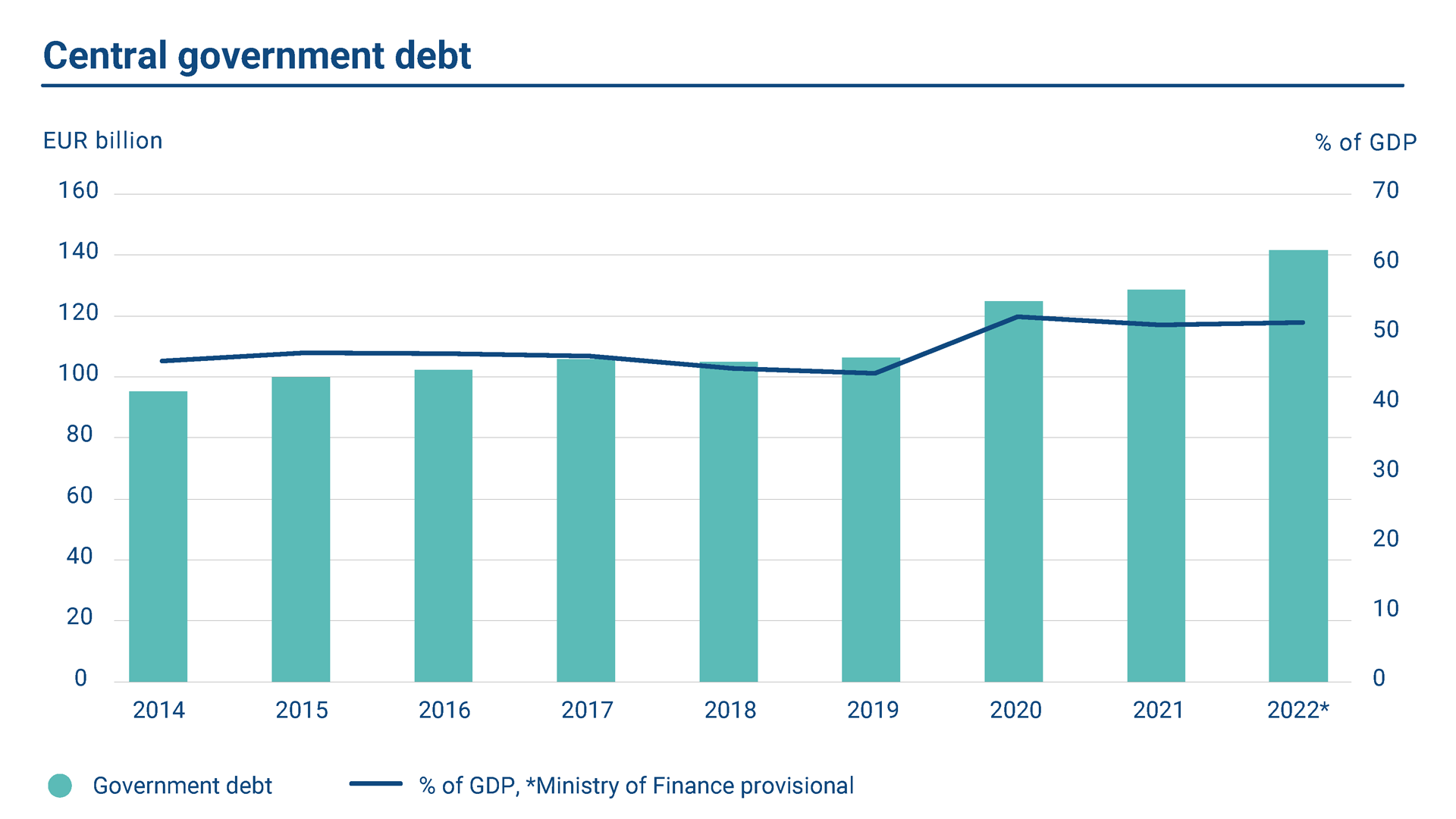

Subsequently, approximately EUR 6.6 billion less funding than foreseen in the budget was sufficient to cover expenditure and safeguard a sufficient liquidity position of the central government. The realised net borrowing amount was thus EUR 12.68 billion. At the end of 2022, the central government debt stock amounted to approximately EUR 142 billion.

According to the budget, the net borrowing requirement for the year 2023 is estimated at EUR 10.4 billion. With redemptions of EUR 28.0 billion, the gross borrowing requirement amounts to EUR 38.4 billion for the year.

The funding strategy for the year 2023 is to issue three new euro benchmark bonds in syndications, and to tap existing euro benchmark bonds in regular auctions. Market conditions permitting, issuance in currencies other than the euro, potentially a USD benchmark bond, may complement the long-term funding. The share of short-term funding, i.e. Treasury bills, is estimated to account for about 50% of the gross annual borrowing amount.

Funding Strategy

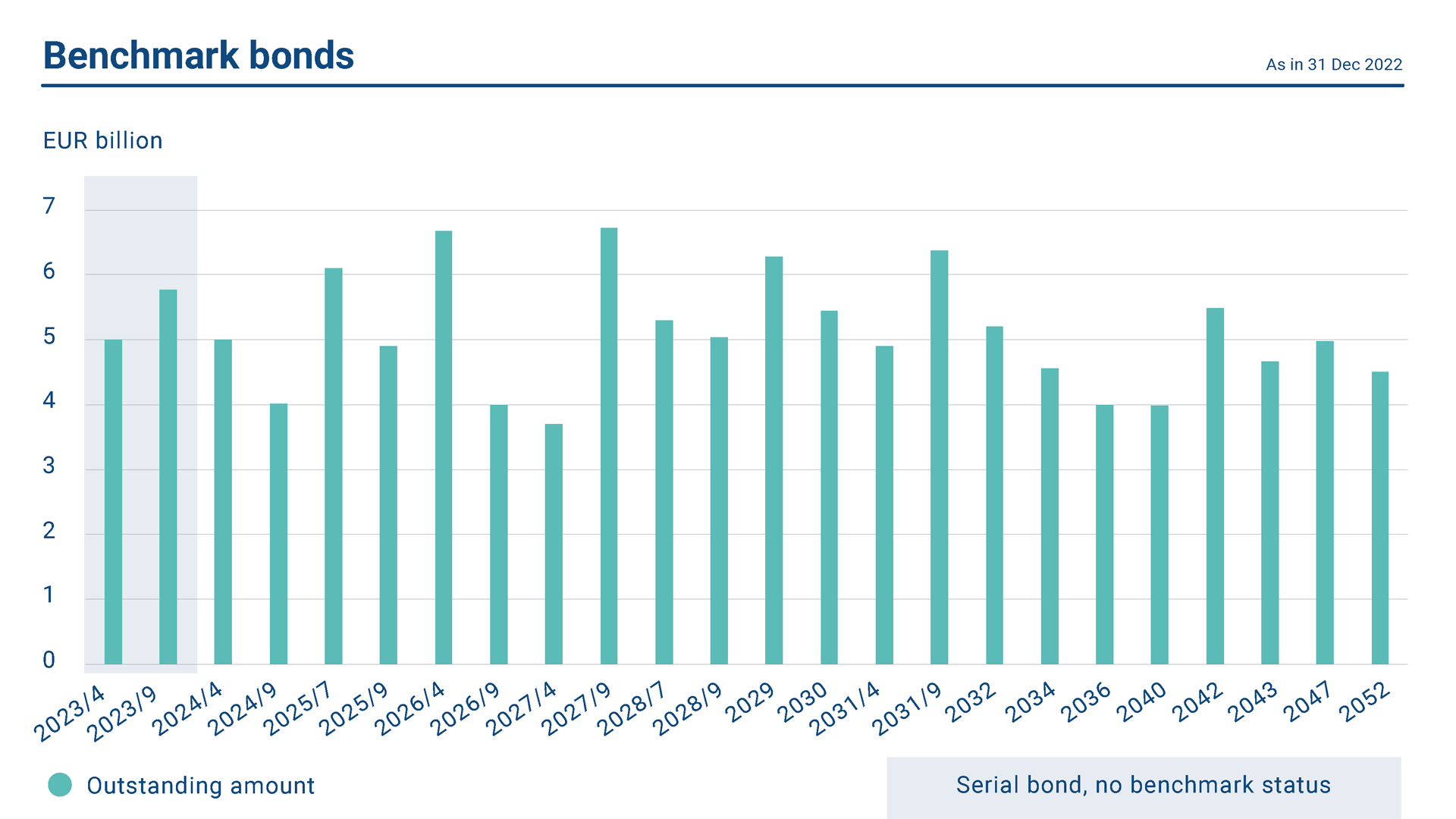

The funding strategy of the Republic of Finland is based on euro benchmark bond issuance. New benchmark bonds are issued in syndicated form. Syndications are complemented with bond tap auctions, which enable increases in the outstanding volumes of the existing bond lines. There is also a foreign currency bond issue programme, called the Euro Medium Term Note (EMTN) programme. The Republic of Finland is committed to issuing in other currencies than the euro to complement its euro-denominated borrowing and to serve a broader base of investors. However, issuance in foreign currencies is subject to market conditions and a reasonable funding cost in comparison to euro issuance.

The current funding volume supports three new euro benchmark bond syndications per year, tap auctions on benchmark bonds, and one benchmark-sized USD bond issue. The short-term funding is carried out by issuing Treasury bills. In terms of maturities, the focus is on issuing current coupon bonds in 5- and 10-year tenors annually. Subject to market conditions and to facilitate sufficient curve maintenance for a liquid benchmark curve up to 30 years, benchmark issues in 15, 20 and 30 years will be conducted accordingly.

The State Treasury is motivated to preserve Finland’s place in the global markets as one of the reliable and acknowledged bond issuers and thus maintain attractive debt instruments and bond issuance in the future.

Funding operations

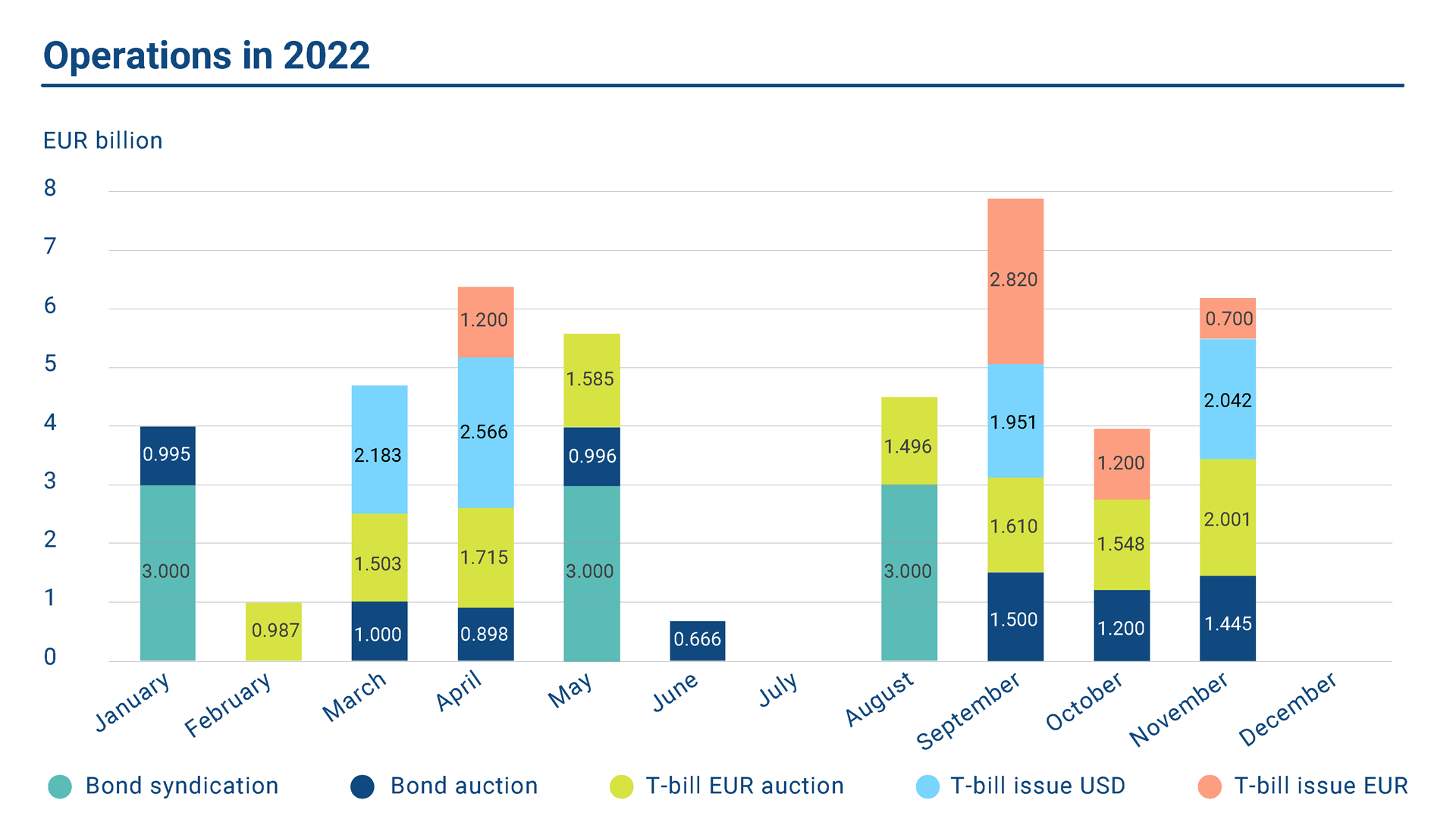

In 2022, the Republic of Finland issued three new euro-denominated benchmark bonds and conducted eight benchmark bond auctions. In addition, the short-term funding was carried out with Treasury bill auctions and issuance in ECP format.

Three new benchmark bonds were issued in syndicated format, with an issue size of EUR 3 billion each. The first one, in January, was a new 20-year benchmark bond maturing on 15 April 2043. The bond attracted an order book of over EUR 16 billion with over one hundred investors, including investors such as European pension funds, public institutions, and fund managers.

The second bond issue in May was a new 10-year benchmark bond maturing on 15 September 2032. Despite the global turmoil, the bond received solid demand and an order book of over EUR 13 billion from 80 investors, mostly from UK and central European countries.

The third syndicated bond issue of the year was a new 5-year tenor maturing on 15 April 2027. It was issued in late August, and despite the continuing market volatility, the investor allocations in the issue turned out very typical for the maturity. The bond attracted an order book of over EUR 10 billion from over 60 investors.

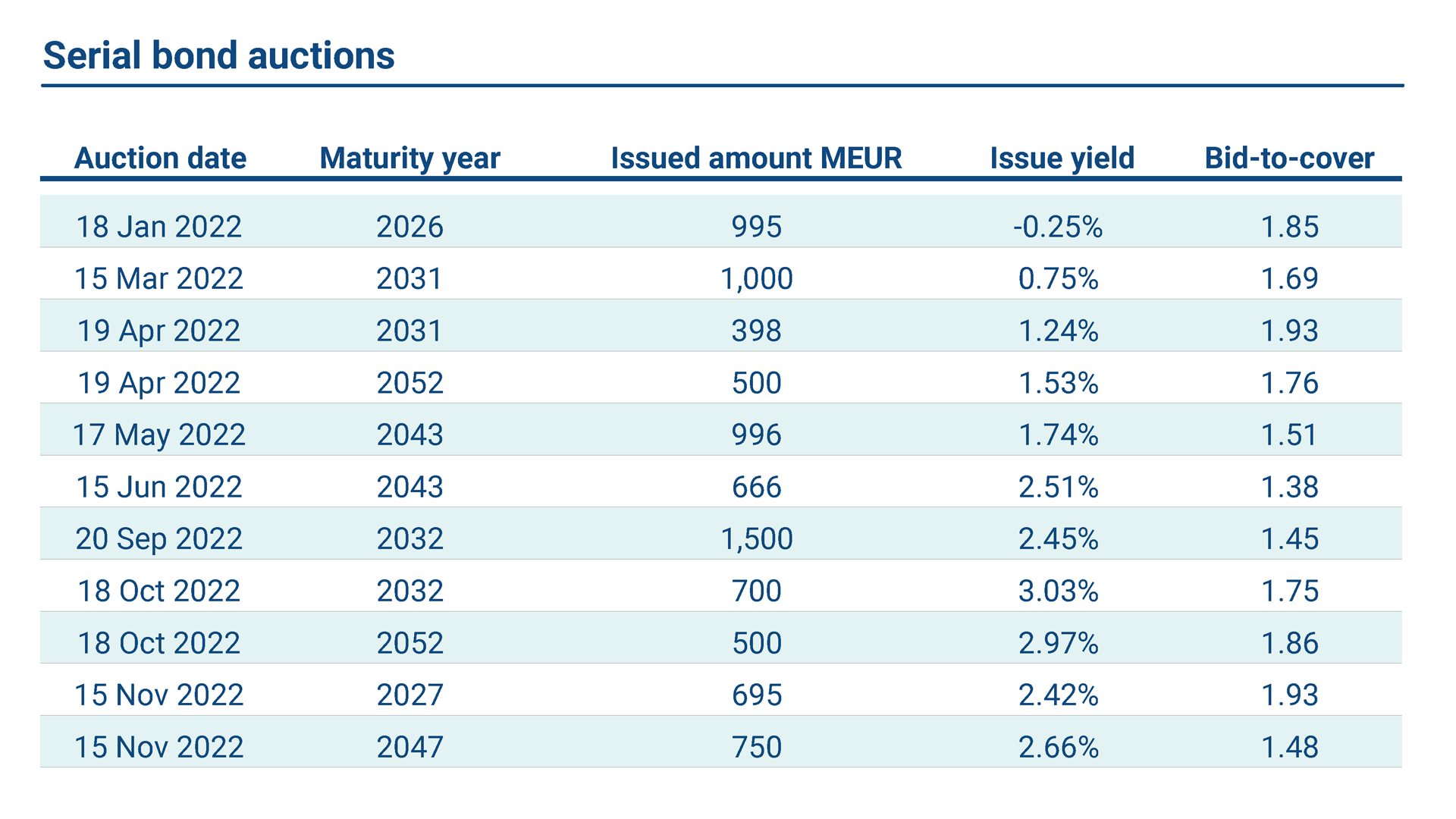

Tap Auctions

The State Treasury publishes a quarterly auction calendar on bond auctions. In 2022, a total of eight bond auctions on existing euro benchmark bonds were conducted. All auctions for the Republic of Finland serial bonds are tap auctions for existing lines. Five auctions took place in the spring term, and three in the autumn term. The total funding volume via serial bond auctions was EUR 8 700 million (EUR 7 235 million in 2021). Three of the auctions were dual lines with two separate bonds with different maturities auctioned in the same auction. The bid-to-cover ratio, which describes the demand for the auctioned securities, varied between 1.38 and 1.93. The issued amounts were between EUR 392 million and EUR 1 500 million per bond per auction.

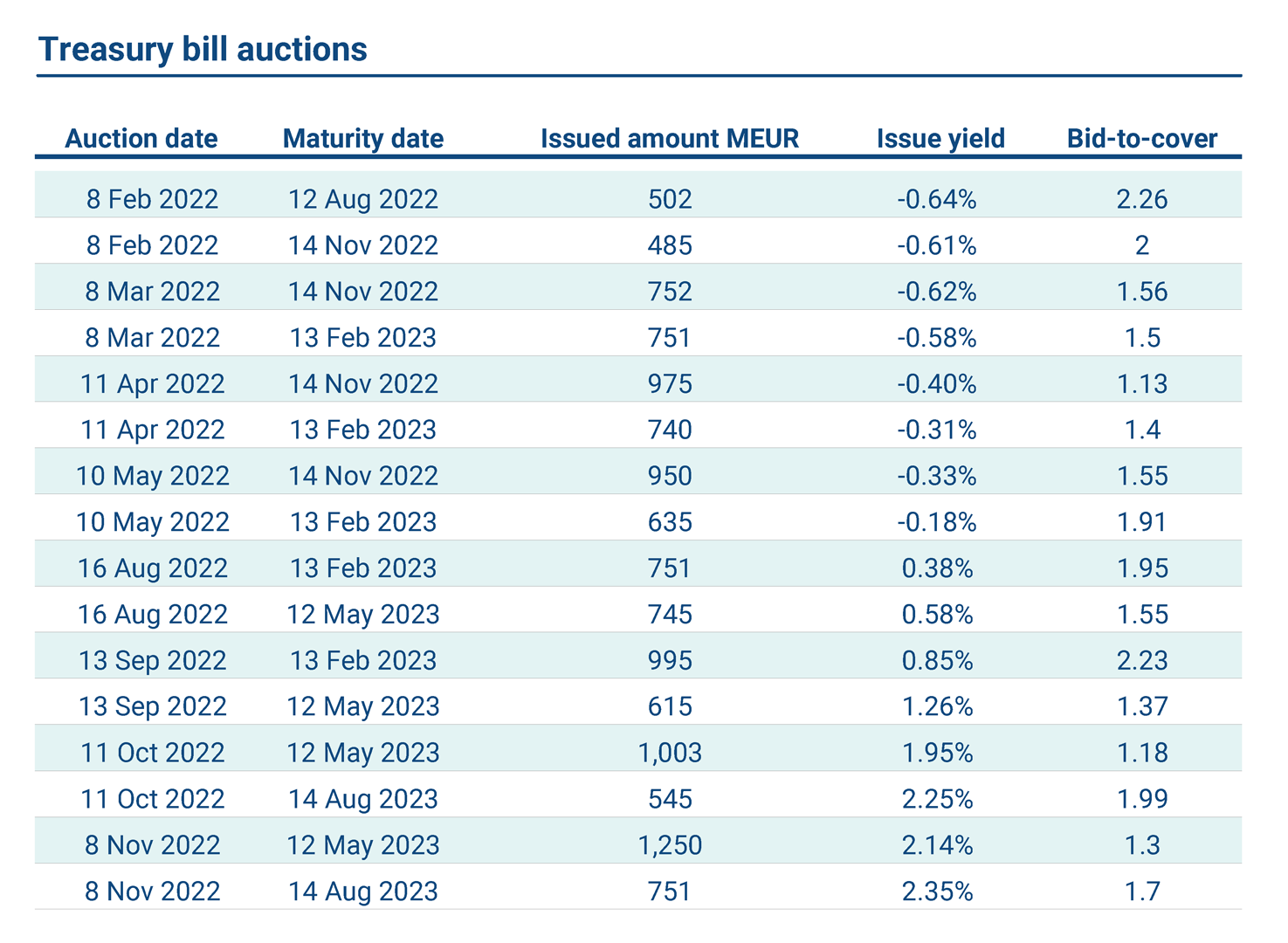

Short-term funding

The State Treasury issues Treasury bills in euros and US dollars through banks included in the Treasury Bill Dealer Group, according to the financing needs of the central government and in line with guidelines set by the Ministry of Finance.

In 2022, as in previous years, the State Treasury continued to issue euro-denominated Republic of Finland Treasury bills in auctions. In auctions, the price of the security is determined by the bids submitted by the participating counterparties, which for the Finnish Treasury bills are the Treasury Bill Dealer Group. In 2022, eight Treasury bill auctions were conducted. The total funded amount raised in Treasury bill auctions was EUR 12.4 billion.

The State Treasury may also issue Treasury bills on other occasions, depending on the demand and financing needs, in which case the State Treasury defines the reference price for the issue. This issuance method resembles that of European Commercial Paper programmes (ECP). Treasury bills in ECP format may be issued in two currencies: in euros and in US dollars.

In 2022, the ECP format Treasury bill issuance window in USD and EUR was open occasionally during March and April in the spring, and during September, October and November in the autumn. The gross ECP issuance in USD was USD 9.3 billion, and in EUR 5.9 billion.

The average maturity in USD ECP issuance was 4.7 months, and in EUR ECP issuance 4.8 months. The outstanding stocks of USD- and euro-denominated Treasury bills at year end were USD 4 116 million and EUR 13 501 million (USD 1 600 million and EUR 10 363 million on 2021).

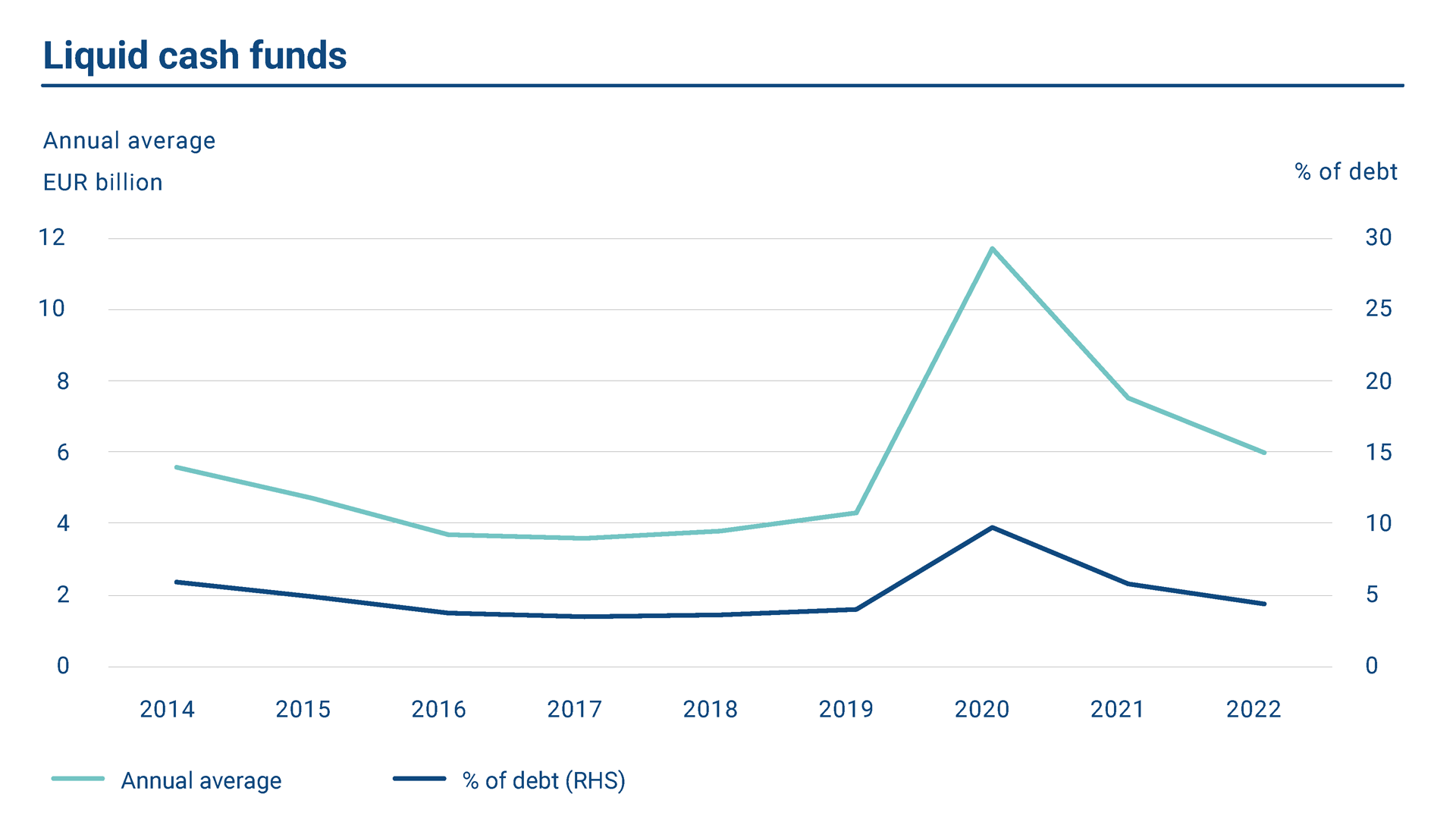

Liquidity management

The amount of government cash reserves is based on an assessment of sufficient liquidity and a limit on uncovered net cash flows. Actual cash flows exhibit both intra-month and annual seasonal patterns due to timing mismatches in income and expenditure. Changes in the budget deficit during the fiscal year also affect liquidity management via changes in funding requirements.

As the primary focus is sufficient liquidity, actual borrowing may deviate from that budgeted for the fiscal year for various reasons, e.g. deferrable allowances which are budgeted in a specific year but used over a number of years. In practice, less than budgeted borrowing has often been sufficient to cover liquidity needs. This was the case in 2022, when collateral needs increased funding requirements while some sizable of allowances remained unused, as explained above.

Year-end cash balances may also fluctuate and thus affect the borrowing. In the government financial statement the cash buffer consists of e.g. cumulative budget surplus, deferrable allowances, fund of off-budget entities and other short-term debt.

The cash reserves are invested for short-term maturities with low-risk counterparties. The Eurosystem’s national central banks accept non-monetary policy deposits from EU member state public entities such as debt management offices under a pre-determined set of rules. Thus, the Bank of Finland was a counterparty for short term deposits in 2022. The rules on these deposits were adjusted in September 2022, when the Governing Council of the European Central Bank removed the 0% rate ceiling and set the rate for remuneration of government deposits to remain at deposit facility rate (DFR) or euro short-term rate (€STR), whichever is lower, until 30 April 2023. This temporary change took place in a context of normalisation of monetary policy, and according to the ECB, does not alter the long-term desirability of encouraging market intermediation.

Liquidity management relies strongly on the cash flow forecast system. All government accounting entities forecast their income and expenditures for the next 12-month period into the system. The State Treasury is using this data as a basis for liquidity management decisions.