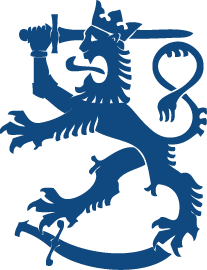

Finland’s economy drifted into a recession at the end of the year, as investments and household consumption declined. Finland’s GDP is expected to have contracted by 0.5% in 2023. With rising interest rates hitting consumption and investments, the economy performed weaker than expected particularly in the latter part of the year. Employment started to fall from its peak in late 2023 but is nevertheless high at 73.3%.

Year 2023 was marked by an economic slowdown both in Finland and internationally. In Finland, a negative turn took place in the third quarter when economic output clearly fell. Construction was hit hardest but services growth stalled too.

Exports from Finland declined but significantly less than imports. Net exports therefore made a clearly positive contribution to the economy in 2023. Exports are expected to return to growth this year as world trade recovers and Finland’s cost-competitiveness is in good shape.

The main reason for the rapid slowdown in inflation in 2023 was the fall in energy prices. In the latter part of the year, the slowdown in prices was more broad-based. In Finland, the average inflation rate was 6.2 per cent in 2023 but at the end of the year, inflation was already significantly lower than this at 3.6 per cent.

The economy is estimated to grow again in 2024 as slowing inflation and expected fall in interest rates, combined with moderately strong household income growth, will increase the purchasing power of Finnish households.

Public finances

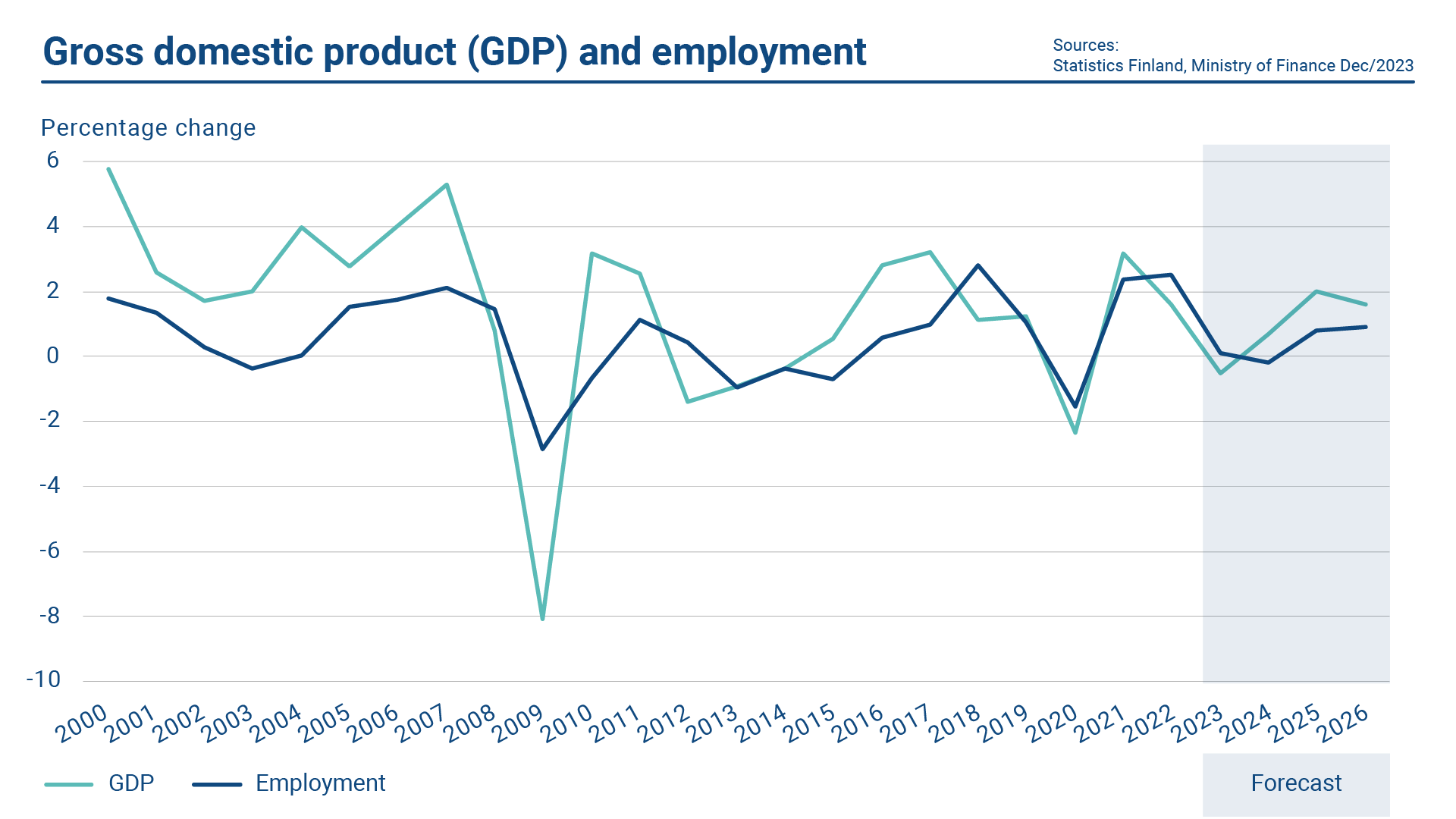

General government finances improved in the two previous years as the pandemic abated. However, the improvement was temporary and in 2023 general government deficit is estimated at 2.5% of GDP. As inflation-driven growth in expenditure has weakened the general government budgetary position and tax revenue growth is sluggish, the deficit is set to deteriorate to above 3% of GDP in 2024 – after which it is expected to improve slowly due to the Government’s measures and economic growth. General government expenditure is affected by rising interest expenditure and several previously decided measures, including substantial defence investment.

The general government deficit is balanced by the surplus in the social security funds, despite the central government, the local government, and the wellbeing services counties (that became operational on 1 January 2023) all being in deficit.

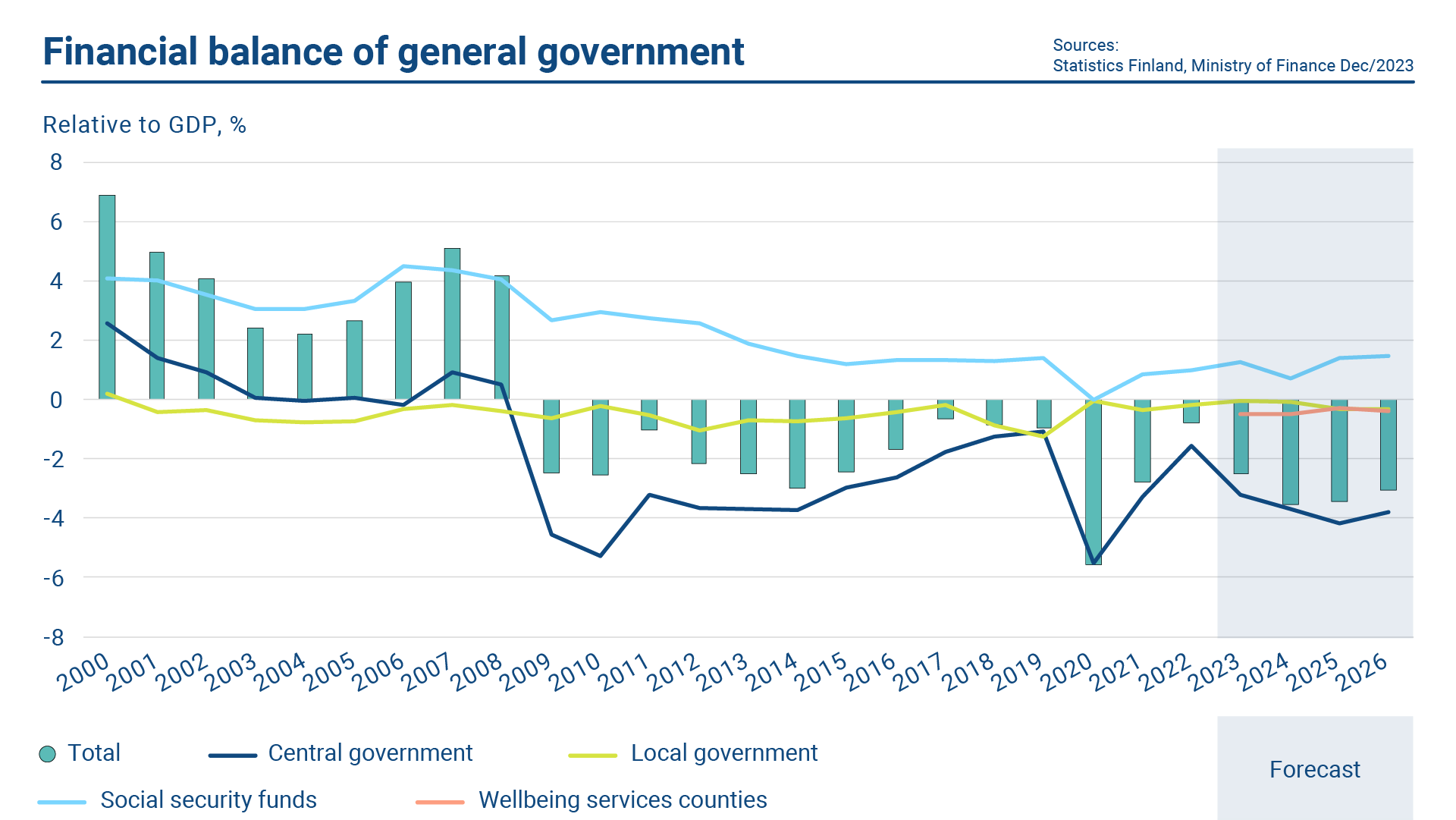

At the end of 2023, the general government debt stood at 75.5% in relation to GDP. This represented an increase of 2.2 percentage points from the previous year. Despite adjustment measures, the debt ratio is expected to rise. The estimate for the central government debt is 55.4% of GDP – up from 52.7% from the previous year – while the central government deficit is estimated to be 3.2%.[1]

Finland’s credit strengths such as relatively strong public finances, competitive economy and stable institutions, among other things, are reflected in Finland’s high credit ratings. The central government of Finland has solicited credit ratings from Fitch Ratings and S&P Global Ratings. In 2023, they both affirmed Finland’s credit rating at AA+ with stable outlooks.

[1] All estimates are from the Ministry of Finance’s Economic Survey, Winter 2023.

Interest rate developments

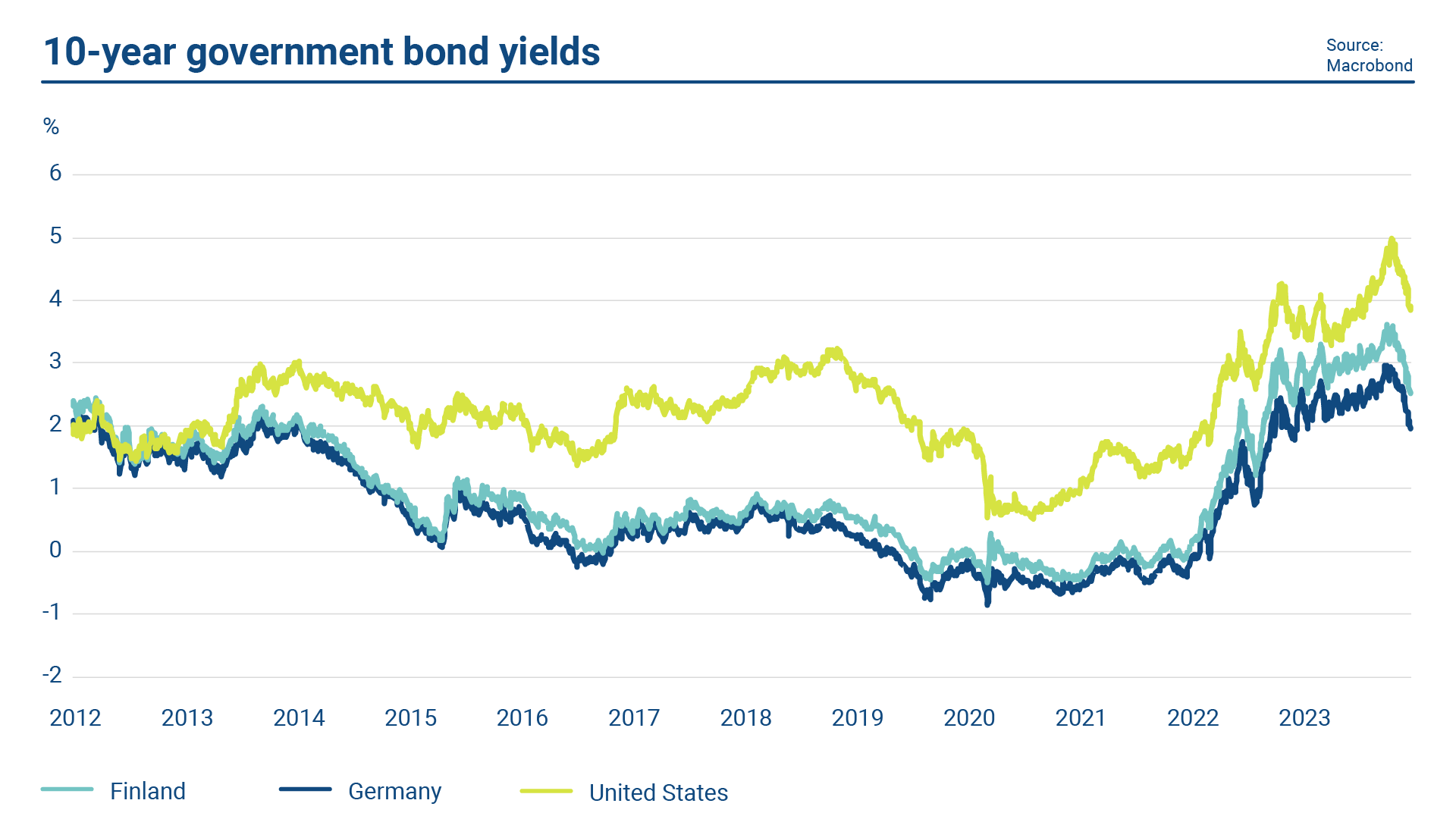

Global central banks continued their fight against inflation and restrictive monetary policies in 2023. Adding to the previous year’s rate hikes both the Federal Reserve in the United States and the European Central bank (ECB) raised their main policy rates on several occasions. The ECB’s rate hikes in 2023 amounted to 2 percentage points and the last hike took place in September. As the inflationary outlook started to ease in the second half of the year, market expectation on central bank pivots accumulated and resulted in falling government bond yields in the final quarter of the year. With that pivot expectation also equity market performance improved even when a soft landing for the economy could by no means be taken for granted.

While hiking rates the ECB has started winding down monetary policy purchasing programmes. The latest signal is the reduction of reinvestments in the Pandemic Emergency Purchasing Programme (PEPP) which is to take effect in the second half of 2024. The Public Sector Purchasing Programme (PSPP) has refrained from reinvestments already since March 2023 thus effectively resulting in quantitative tightening and a reducing bond portfolio, without express sales though. Despite these developments and a continued government bond supply in Europe, many markets witnessed falling rates in late 2023. This applied also to Finnish government bond markets with the 10-year benchmark bond yield, which opened the year at 3.04%, falling to 2.57% at year end. After the historically rapid rise in absolute yields from zero interest levels during 2022, the 10-year RFGB benchmark bond has yielded on average 3.06% in 2023.

Secondary market developments

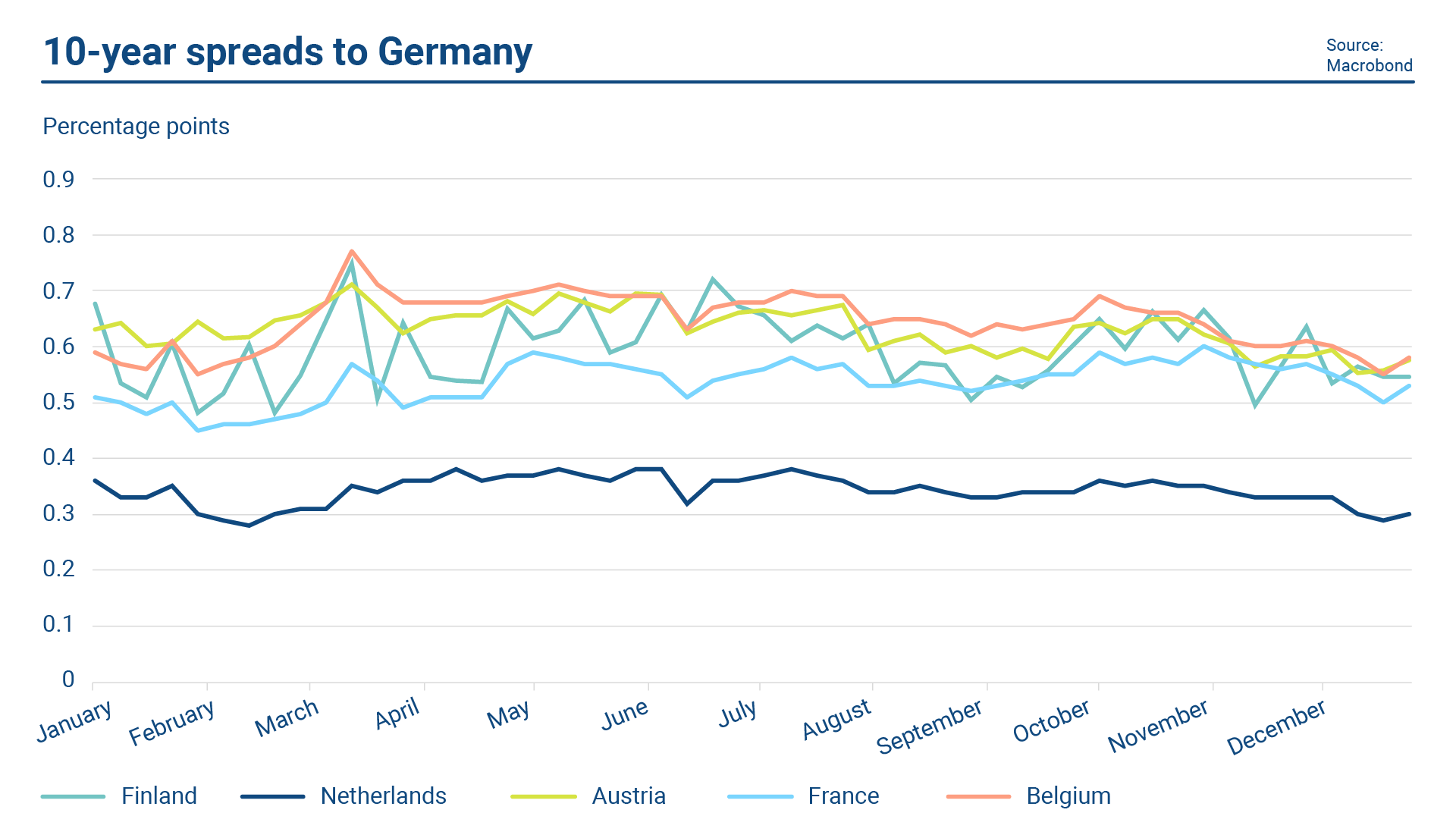

Following the central bank monetary policy tightening cycle yields for European government bonds (EGB) were on a rising trend for the first three quarters of 2023. The banking turmoil experienced in the US in March and bank restructuring in Europe added to uncertainty and volatility in the markets, and consequently the asset swap spread levels in EGBs were affected at the time. The Finnish 10-year spread to German government has been broadly stable during 2023, with some widening in the second quarter followed by and equal tightening towards the end of the year. Peer sovereigns, like the Netherlands and Austria, depict a broadly similar pattern.

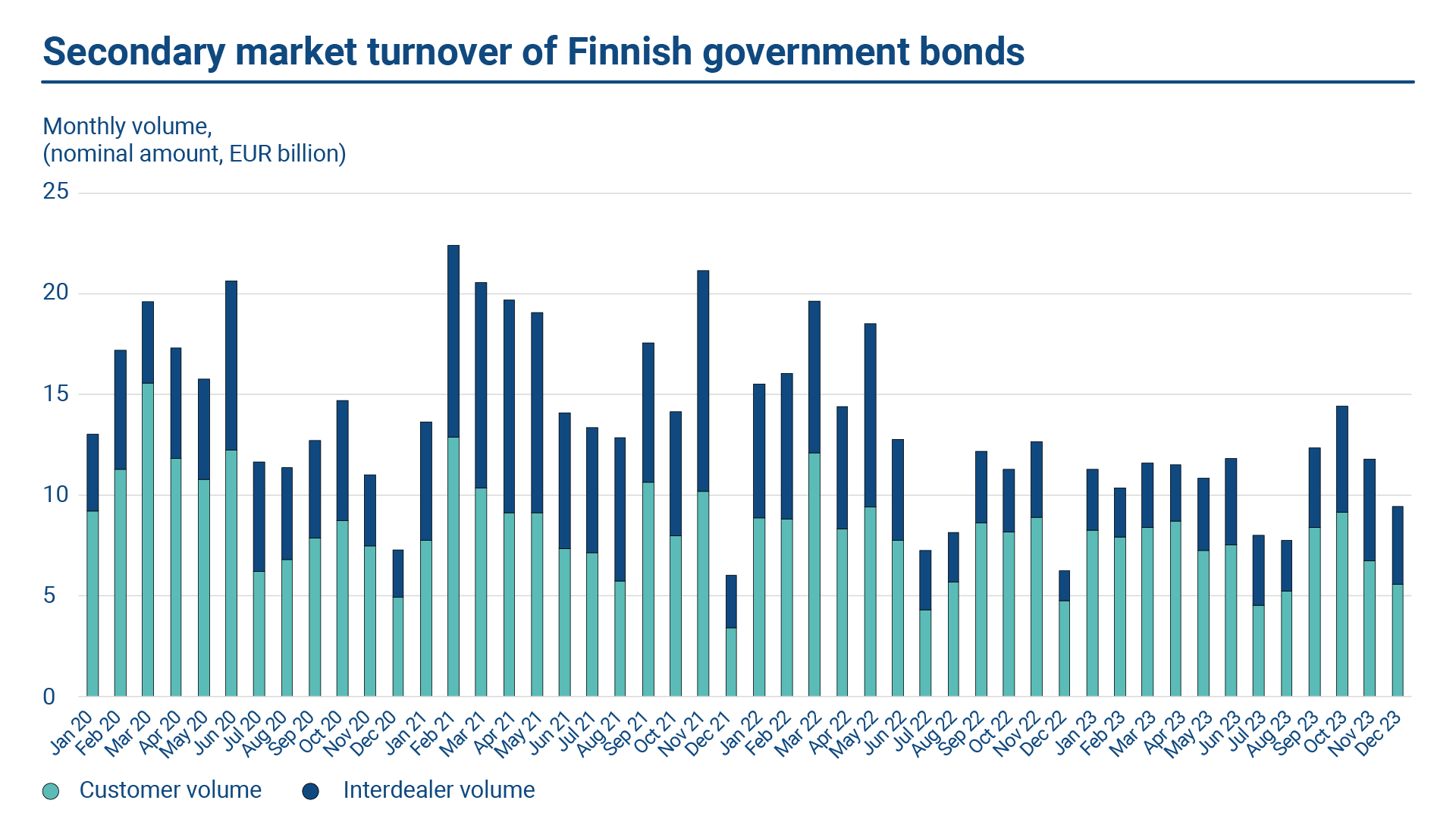

It is a priority for the State Treasury to work actively with the primary dealers to maintain and further enhance the liquidity of the Finnish government bonds. Primary dealers report customer trade volumes to the State Treasury within the Harmonized Reporting Format as agreed by the EFC Sub-Committee on EU Government Bonds and Bills Markets.1 The reporting takes place on a monthly basis, and the data is consolidated and used for monitoring and analysis. According to the HRF data, the overall secondary market customer turnover volume decreased slightly in comparison to 2022. This falling trend started in 2020. The annual turnover in total was EUR 87.70 billion (95.75 billion in 2022). The average monthly turnover (sales and purchases) was EUR 7.3 billion in 2023 (EUR 8.0 in 2022). In relative terms, the monthly average turnover volume was 6.1% of the total outstanding euro benchmark bond stock (7.2% in 2022).

Finnish government benchmark bonds can be traded on the MTS Finland and ICAP BrokerTec interdealer platforms. The State Treasury does not participate in secondary market activity, and the interdealer trading is based on the activity of the primary dealers and other market participants. In 2023, the nominal interdealer trading volume (turnover, i.e., sales plus purchases) was on average EUR 3.6 billion per month (EUR 4.9 billion in 2022). The trend in the interdealer trading volumes has been falling already for three consecutive years. In 2023 the reduction in volume was partially due to a reduction in quoting size requirements for the Primary Dealers.

The State Treasury actively follows the primary dealer quoting activity in the secondary markets. There are guidelines for the Primary Dealers on quoting for different maturities in the interdealer market, where the bid-offer spread of the price quotes is observed and tracked. The average bid-offer spread of all the market makers is calculated and each Primary Dealer benchmarked against the average. On a weekly basis, the State Treasury reports the analysed spread data for the benchmark bond quotes back to the individual Primary Dealer banks. The secondary market liquidity for RFGBs improved in 2023 in terms of tighter bid-offer spreads in comparison to 2022.

The State Treasury introduced Optional Reverse Inquiry auctions for off-the-run benchmark bonds in March 2023. This facilitated a reduction or disappearance of repo specialness for all RFGBs. Furthermore, there is a repo lending facility offered for the primary dealers. The existence of these liquidity support facilities has received positive feedback from dealers and supports the overall market making capacity for banks.

1 Using Harmonized Reporting Format, the national data on secondary market turnover from each euro area country is then aggregated into Euro Market Activity Report (EMAR), published by the ESDM on a quarterly basis. Further information here.