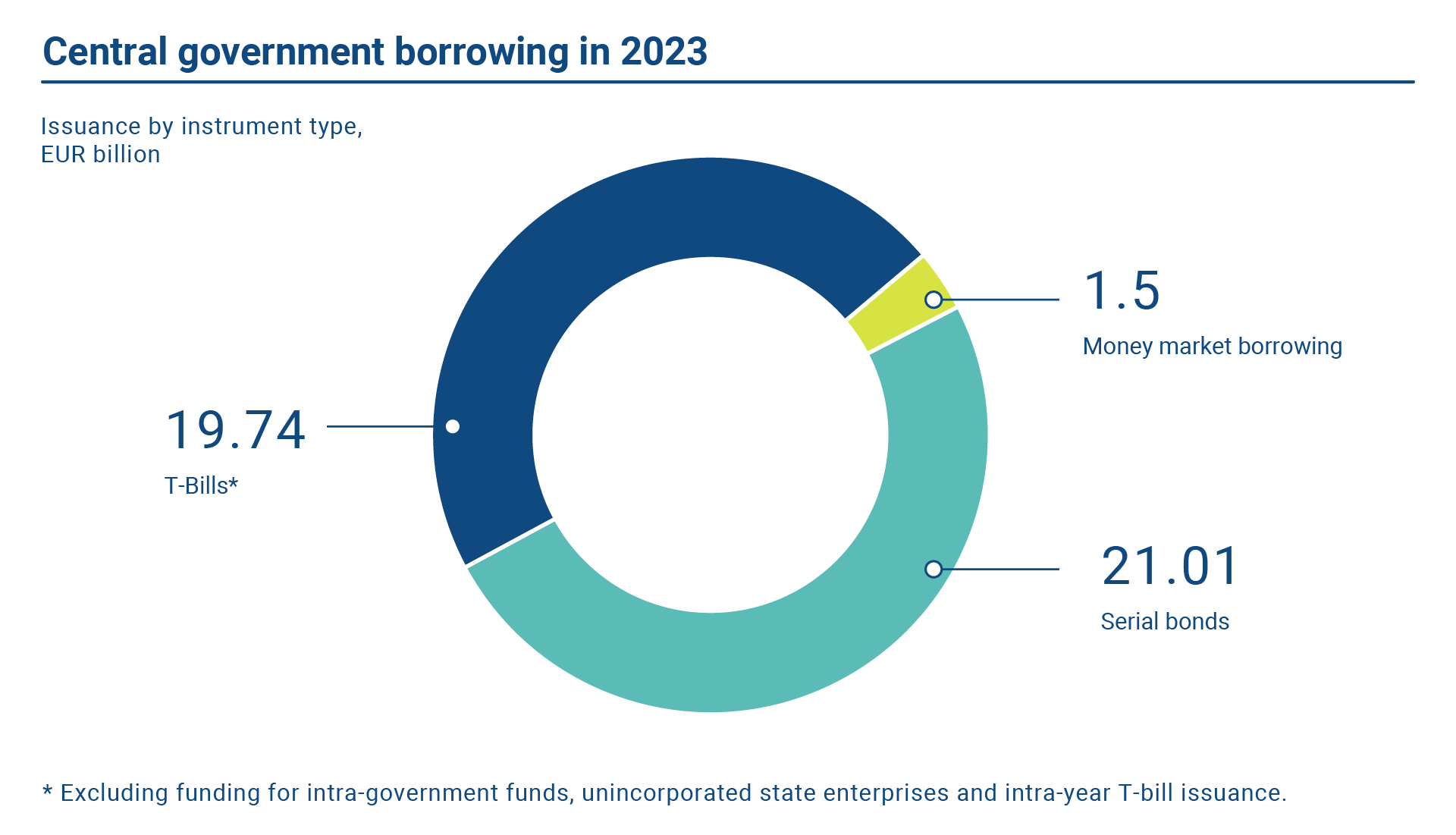

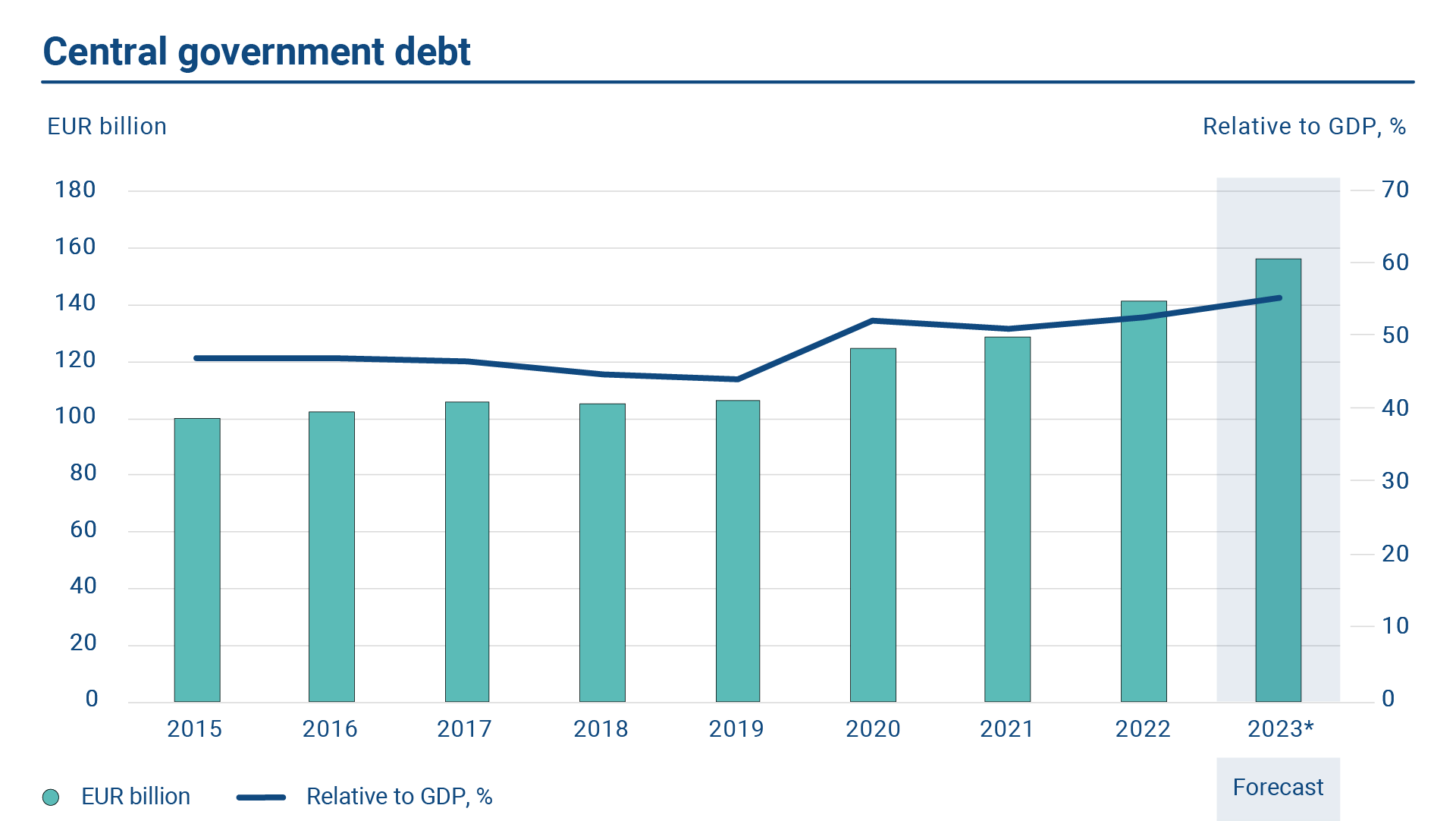

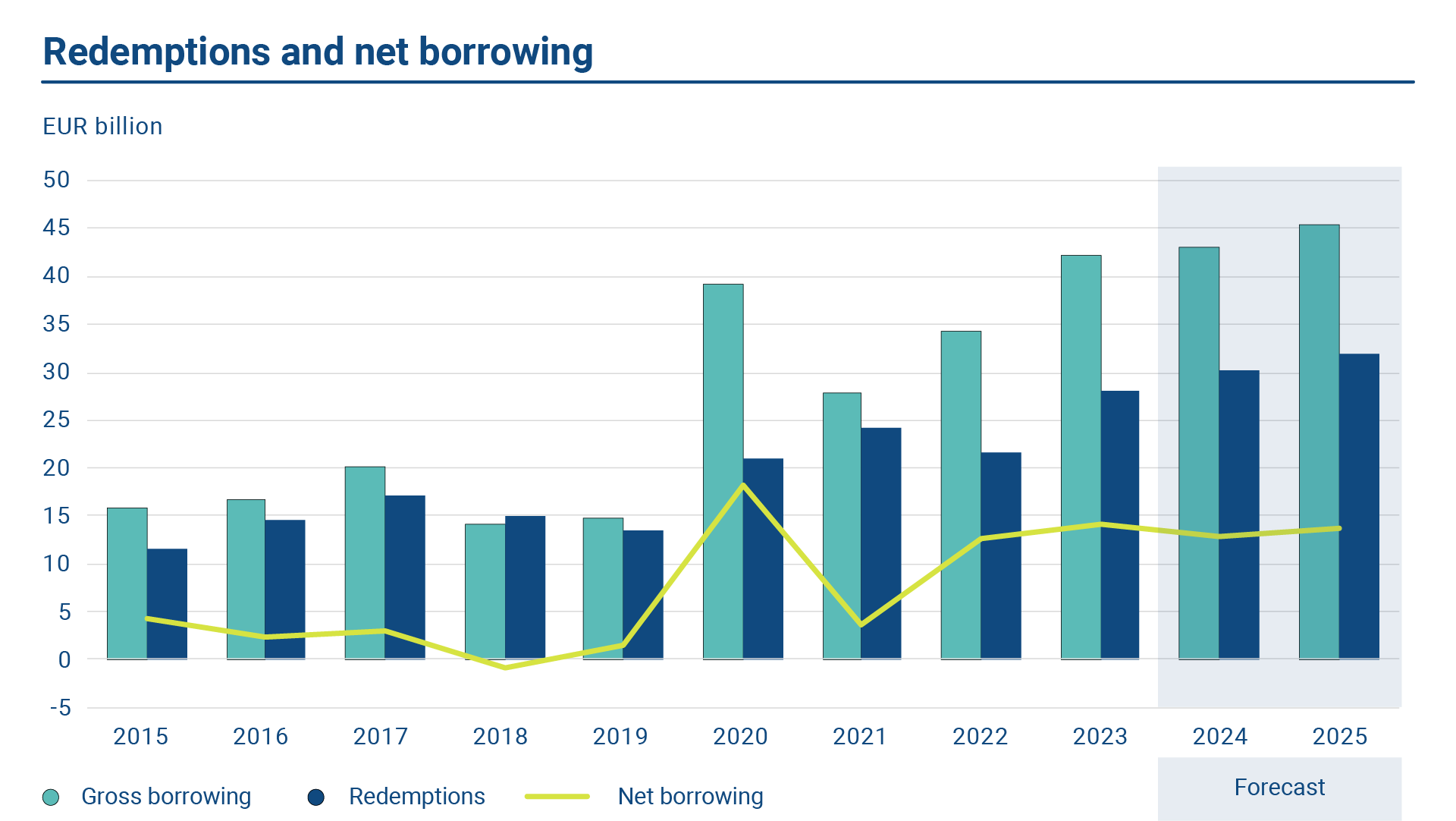

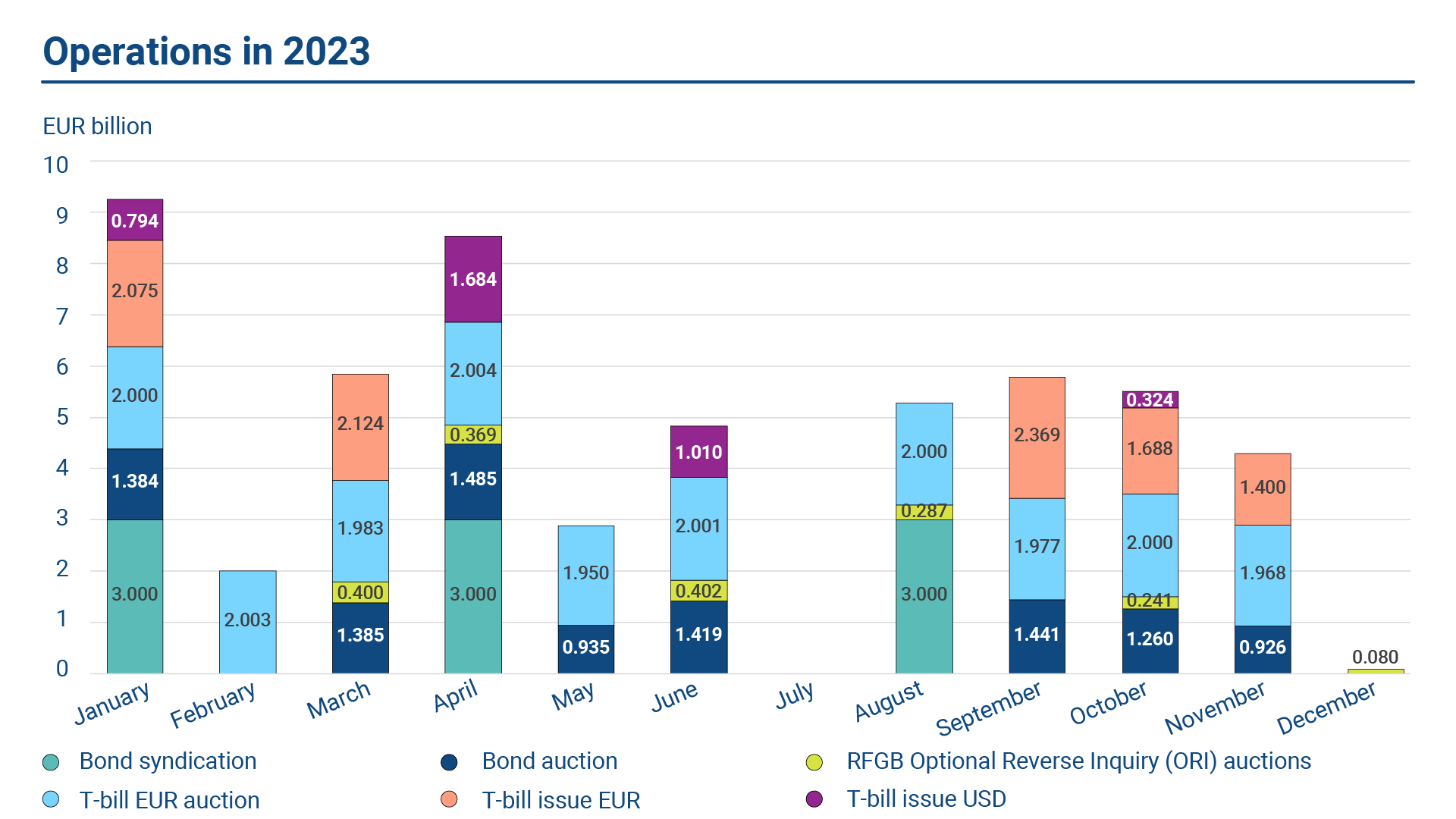

In 2023, the realised gross borrowing totaled EUR 42.251 billion. Of this amount, long-term issuance accounted for EUR 21.014 billion. The rest, EUR 21.237 billion, was short-term borrowing. In the coming years, the gross borrowing requirement is estimated to follow this year’s pattern and to remain around EUR 40-45 billion annually.

The budgeted gross borrowing in 2023 was EUR 39.259 billion, including EUR 11.221 of net borrowing. Due to a significant amount of central government expenditure falling due on 2 January 2024, a liquidity buffer was built already before year end, which resulted in larger realised borrowing in comparison to budgeted amounts. Thus, the realised gross borrowing in 2023 was EUR 42.251 billion, and the realised net borrowing amounted to EUR 14.214 billion. At the end of the year, the central government debt stock reached approximately EUR 156 billion.

According to the forecast by the Ministry of Finance, the estimated net borrowing requirement for the year 2024 is EUR 12.879 billion. With EUR 30.252 billion of redemptions, the gross borrowing requirements totals EUR 43.131 billion.

Funding Strategy

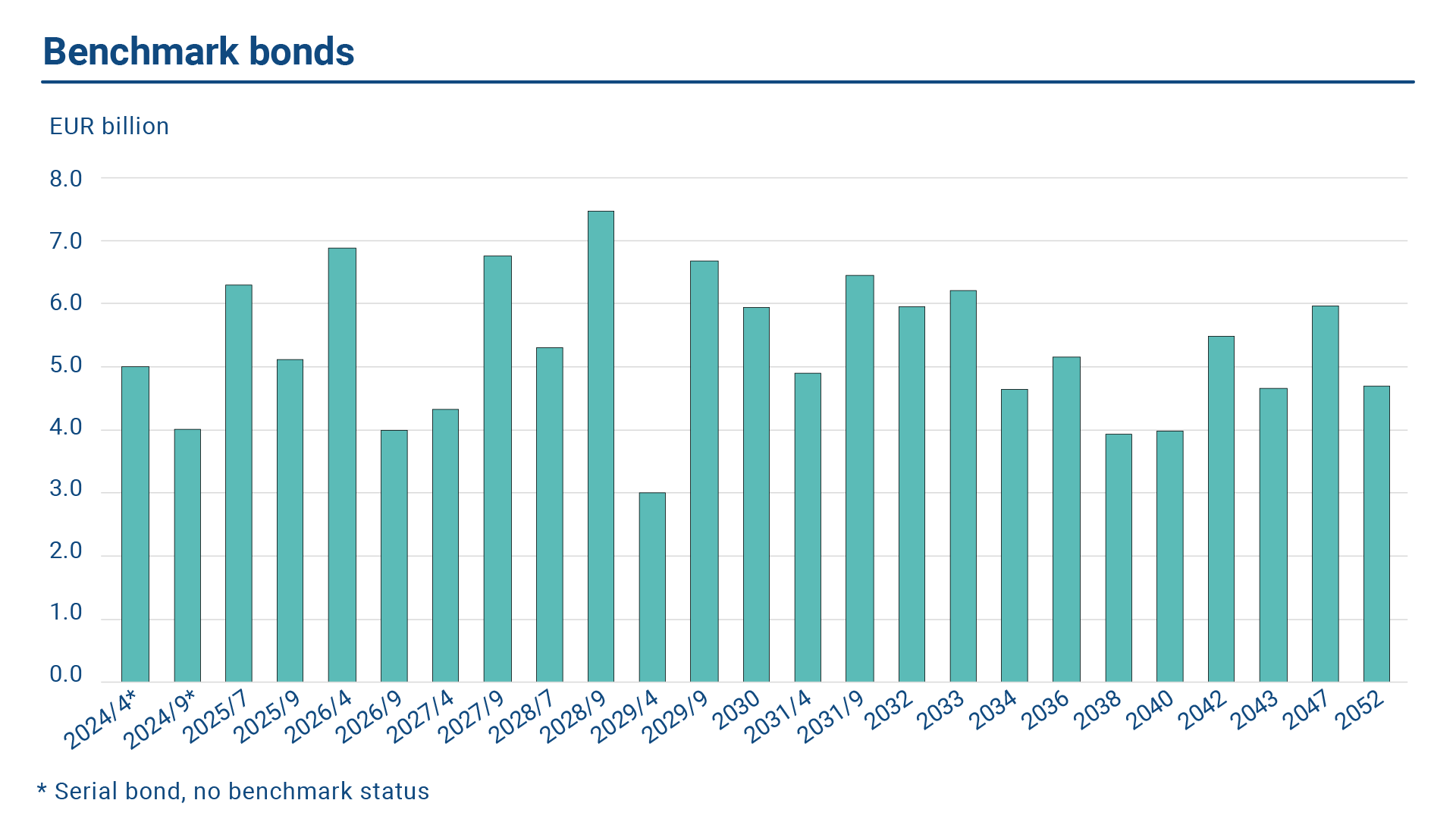

The funding strategy of the Republic of Finland is based on euro benchmark bond issuance. New benchmark bonds are issued in syndicated form. Syndications are complemented with bond tap auctions, which enable increases in the outstanding volumes of the existing bond lines. There is also a foreign currency bond issue programme, called the Euro Medium Term Note (EMTN) programme. The Republic of Finland is committed to issuing in other currencies than the euro to complement its euro-denominated borrowing and to serve a broader base of investors. However, issuance in foreign currencies is subject to market conditions and a reasonable funding cost in comparison to euro issuance.

The current funding volume supports three new euro benchmark bond syndications per year, tap auctions on benchmark bonds, and one benchmark-sized USD bond issue. The short-term funding is carried out by issuing Treasury bills. In terms of bond maturities, the yearly issuance pattern of 5- and 10- year maturities is regularly complemented with a new long-term bond to maintain and secure a liquid benchmark bond curve up to 30 years.

This year, subject to market conditions, the State Treasury aims to issue a new 30-year benchmark bond, in addition to a new current coupon 10-year maturity. Due to the debt redemption profile, the third bond maturity in 2024 is likely to be either a 5-7-year or 15-year long tenor. Market conditions permitting, issuance in currencies other than the euro, potentially a USD benchmark bond, may complement the long-term funding. The share of short-term funding, i.e. Treasury bills, is estimated to account for about 50% of the gross annual borrowing amount.

The State Treasury is motivated to preserve Finland’s place in the global markets as one of the reliable and acknowledged bond issuers and thus maintain attractive debt instruments and bond issuance in the future.

Funding operations

In 2023, the Republic of Finland issued three new euro-denominated benchmark bonds and conducted 14 benchmark bond auctions. In addition, six Optional Reverse Inquiry (ORI) auctions were conducted to support secondary market liquidity in off-the-run bonds. Please see below for a more detailed description of the ORI facility. Short-term funding was carried out in Treasury bill auctions and issuance of bills in ECP format.

The syndicated issues had EUR 3 billion initial issue size for each bond. The first bond was a 15-year maturity due 15 April 2038, and it was issued in January. It carries of coupon of 2.75%. As customary, five primary dealer banks were appointed as lead managers for the issue, and the other primary dealers were included as co-leads. The order book of the issue reached over EUR 11 billion and over 90 investors participated in the transaction. The investors included banks, funds and asset managers, pension funds, public institutions, and hedge funds.

The second bond issue was priced in late April at 1 basis point below the euro swap curve to yield 3.032%. The maturity was 10-years and the due date 15 September 2033. The order book in the syndicated issue grew quickly and attracted participation especially from banks, central banks, asset managers and pension funds. The order book was over EUR 10 billion and 90 investors participated.

The third bond issue in 2023 was a new 5-year maturity due 15 April 2029. The bond was issued in the latter part of August and reached an order book of over EUR 11 billion from over 80 investors. 38% of the issue was allocated to central banks and official institutions – this reflects a strong interest from this investors segment and is potentially a function of the yield spread to peer countries, but also perhaps on the higher absolute yield levels this year.

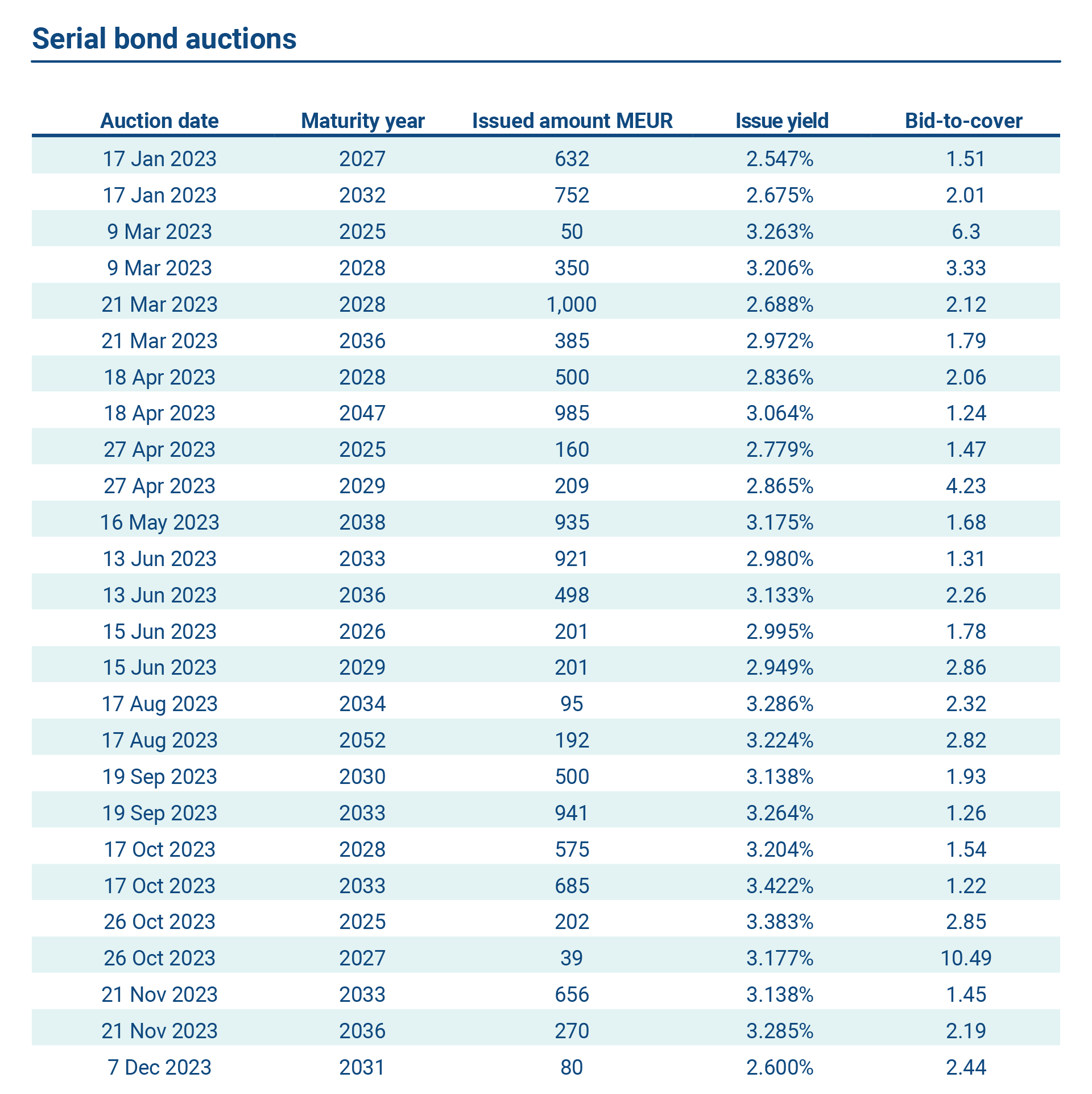

Tap Auctions

In addition to syndicated bond issues, the State Treasury conducts tap auctions on existing euro benchmark bonds in the primary market. An auction calendar is published quarterly at the State Treasury website. In 2023, eight regular bond auctions and six ORI auctions were conducted in total. All auctions of serial bonds are tap auctions of existing lines. Five auctions were arranged in the first half of the year, and three auctions in the latter half of the year. The total auctioned funding volume via serial bond auctions was EUR 12.014 billion, of which EUR 1.779 billion was ORI issuance. All but one of the auctions were dual line auctions, including two bonds with different maturities auctioned in the same auction. The bid-to-cover ratios for the auctioned securities (excluding ORI auctions) varied between 1.22 and 2.86. The issued amounts were between EUR 270 million and EUR 1000 million per bond per auction.

Optional Reverse Inquiry Auctions

The State Treasury introduced an Optional Reverse Inquiry (ORI) facility in March 2023, when the inaugural ORI auction was conducted. The purpose of the facility is to support the RFGB secondary market liquidity, by providing an opportunity for market makers to source off-the-run bonds in the primary market regularly. This improves the market making capacity of the PD banks with end investors and thus bond secondary market liquidity.

An ORI auction is conducted only when one or more Primary Dealers express interest for a particular bond or bonds prior to a scheduled auction date.

In 2023, six ORI auctions were conducted, in line with the quarterly published auction calendar. The total issued amount via ORIs was EUR 1 779 million. The issued amounts were between EUR 80 million and EUR 350 million per bond per ORI auction.

ORI in brief:

- The ORI auctions may take place every second month on the 2nd or 4th Thursday at 11.30 – 12 CET in Bloomberg Auction System.

- The number of potential auctioned lines is limited to two, and the maximum total amount to be issued is EUR 400 million.

- The auction format is a multi-price, meaning that each accepted bid is allocated at the price it was bid, contrary to the regular RFGB auctions, which follow a uniform price format (all accepted bids allocated at the lowest accepted price).

Short-term funding

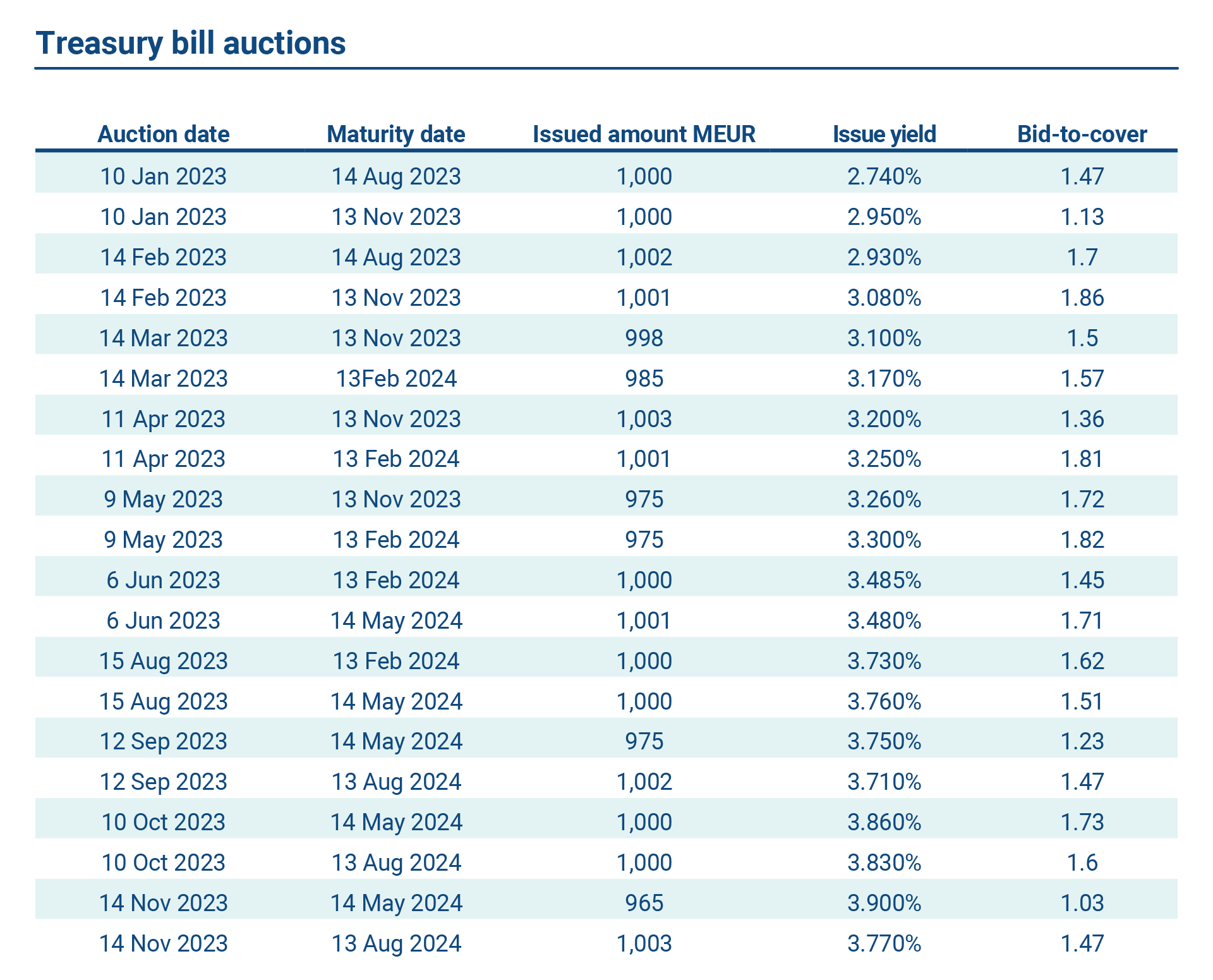

The State Treasury issues Treasury bills in euros and US dollars through banks included in the Treasury Bill Dealer Group, according to the financing needs of the central government and in line with guidelines set by the Ministry of Finance.

Euro-denominated Republic of Finland Treasury bills (RFTBs) are issued via auctions. In auctions, the counterparties in the Treasury Bill Dealer Group can submit bids, and the price of the auctioned security is determined based on the received bids.

In 2023 the State Treasury issued euro-denominated Republic of Finland Treasury bills (RFTB) in 10 auctions. The total amount issued in Treasury bill auctions was EUR 19.737 billion.

The State Treasury may also issue Treasury bills on other occasions, depending on the demand and financing needs, in which case the State Treasury defines the reference price for the issue. This issuance method resembles that of Euro Commercial Paper programmes (ECP). Treasury bills in ECP format may be issued in two currencies: in euros and in US dollars.

In 2023, ECP format Treasury bill issuance was conducted both in USD and EUR based on pricing and demand during the year. The gross ECP issuance in USD was 4.3 billion, and in EUR 9.7 billion.

The average maturity in USD ECP issuance was 6.5 months and EUR ECP issuance 5.3 months. The outstanding stocks of USD- and EUR-denominated Treasury bills at year end were USD 1 800 million and EUR 19 062 million (USD 4 116 million and EUR 13 501 million in 2022).

Liquidity management

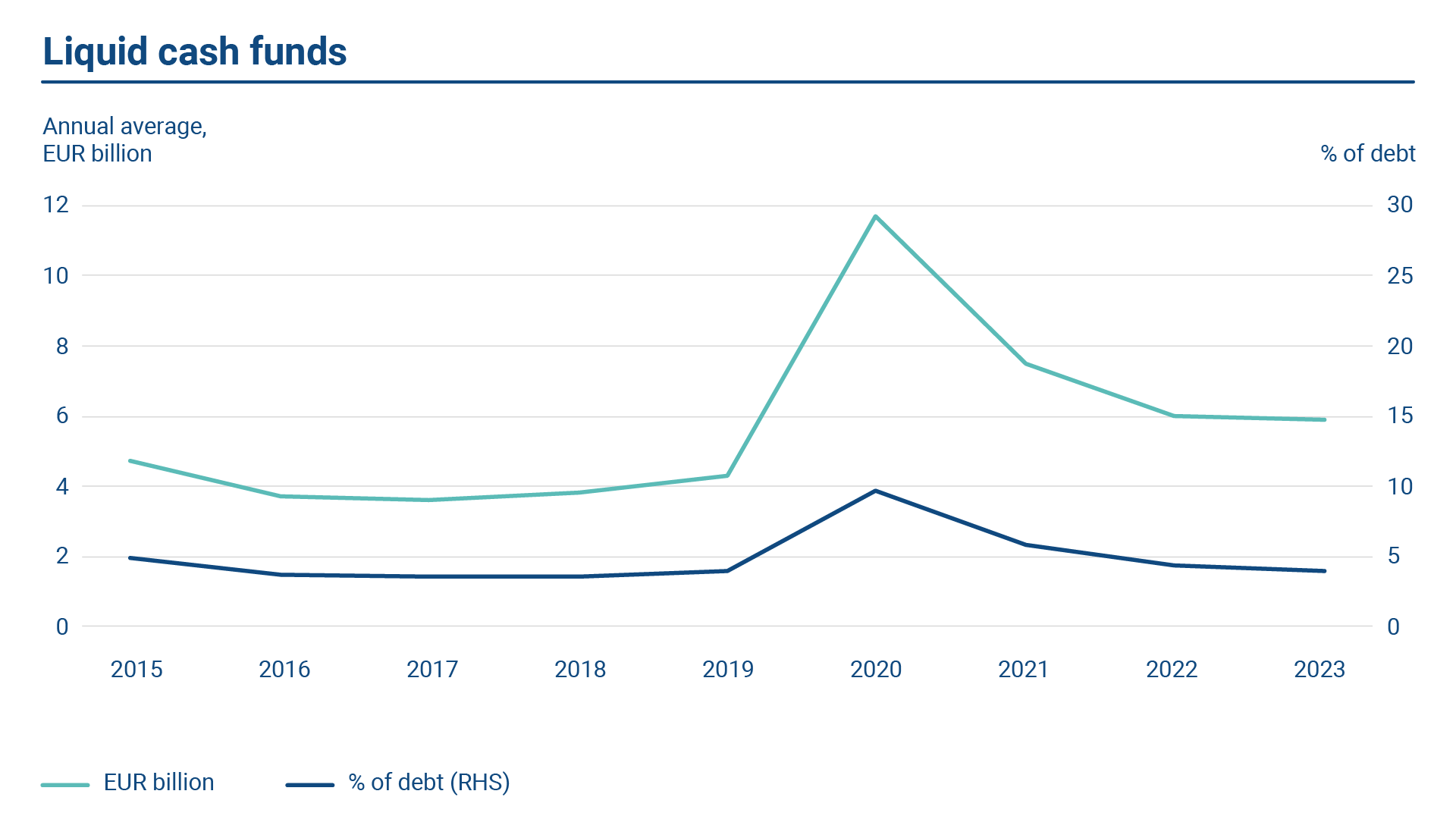

The amount of central government cash reserves varies daily depending on income and expenditure flows. The size of the cash buffer is based on an assessment of sufficient liquidity and a limit on uncovered net cash flows. Cash flows follow both intra-month and annual seasonal patterns due to timing mismatches in income and expenditure. Changes in the budget deficit during the fiscal year also affect liquidity management via changes in funding requirements.

As the primary focus is sufficient liquidity, actual borrowing may deviate from that budgeted for the fiscal year for various reasons, e.g., deferrable allowances which are budgeted in a specific year but used over a number of years. At the end of 2023, a large expenditure (over EUR 4 billion) was due on the first banking day of 2024, and the cash reserves were subsequently boosted before year end to secure sufficient liquidity. This resulted in realised borrowing exceeding the budgeted amount, despite the fall in the posted Credit Support cash collateral during the year, which reduced the funding need.

The cash reserves are invested in very short-term maturities using primarily bank and central bank deposits and triparty repos. The latter means depositing funds with eligible counterparties while receiving a bond or bill as a collateral for the term of the deposit. The collateral is managed by a third party, e.g., central securities depository.

In 2023, the ECB changed the remuneration of government deposits at the national central banks to a lower level from a previously used rate, starting in May 2023. The aim was to provide incentives for a gradual and orderly reduction of such deposits held with the Eurosystem. From May to the year end, the State Treasury was subsequently more active in the triparty repo market with low-risk counterparties using a collateral basket with high-quality collateral.

Liquidity management relies on the central government cash flow forecast system. All government accounting entities forecast their income and expenditures for the next 12-month period into the system. The State Treasury uses this data as a basis for liquidity management decisions.